January 27, 2020

What’s coming to eApp on February 8?

Electronic term conversion and live client identity verification, that's what!

Electronic term conversion application

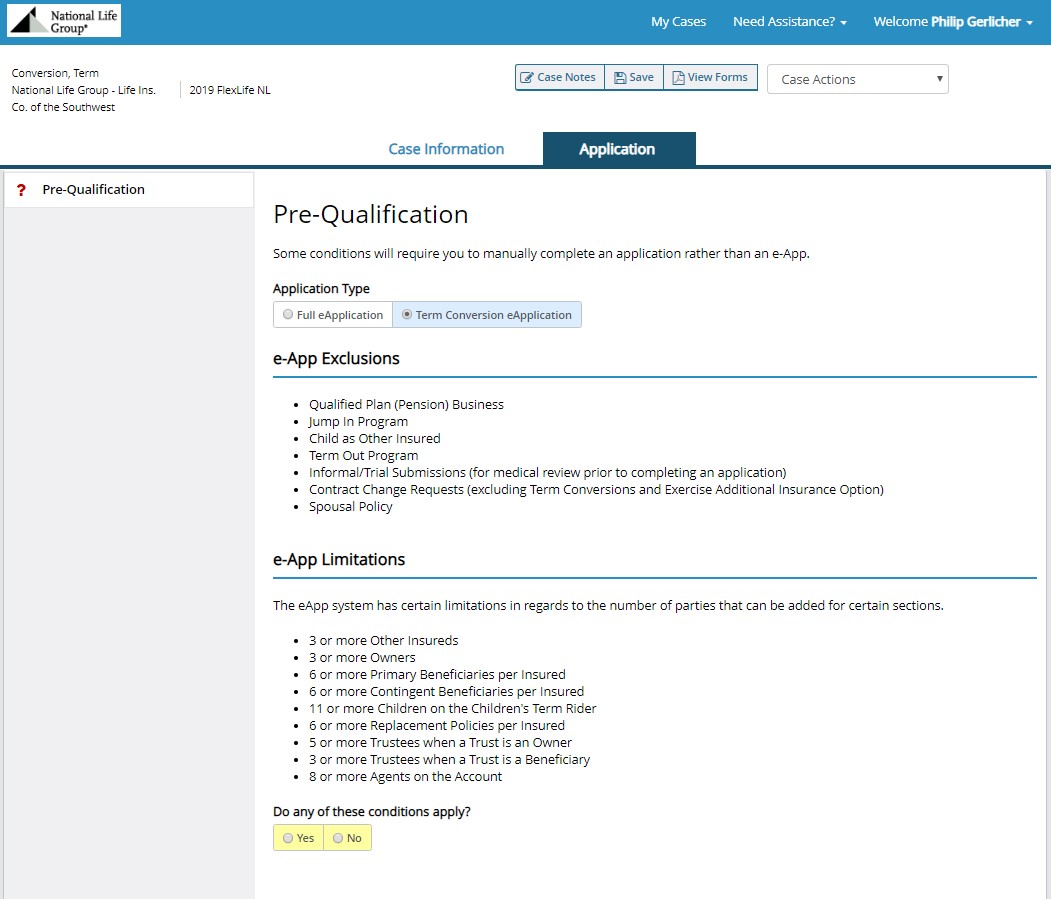

You will have the option to submit Term Conversion applications (Form 20007) electronically.

Simply select Term Conversion on the pre-qualification screen and fill it out as you would via a paper application, now with the added benefit of faster processing!

FAQ’s:

Q: Do these applications go through underwriting?

A: A customer has the option to convert an existing Term policy into a permanent life policy without underwriting. Additional underwriting will be required if the coverage amount is being increased or additional riders are being added. Term Conversions applications will not go through the underwriting engine.

Q: If the new policy will have additional riders or an increase in coverage how do I indicate this?

A: You will be given the option of selecting additional coverage and the appropriate questions will be present, simply answer the questions.

Q: How do we request an owner other than Insured?

A: If the present arrangement is not being used (owner of term policy is not owner of the new policy) please upload the form 1492 with the owner information for new policy

Q: Is this application for situations where they are using their term conversion to increase the face amount on an existing IUL?

A: This application is for a new permanent IUL policy only.

Q: Will the illustration software integration work with this eApp?

A: Integration from ITS will work the same as it does today with eApp. Once Term Conversion is selected, riders that are not eligible will automatically be removed.

Live identity verification of client

eApp will provide real time feedback on a client’s identity based on the input information, for both Life and Annuity applications.

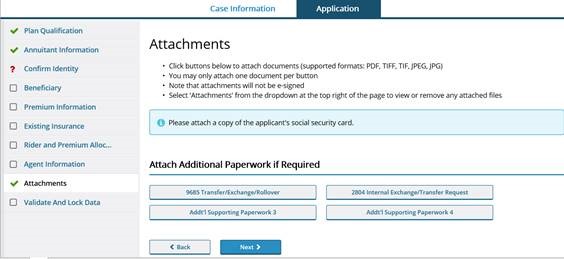

If there are discrepancies between the input information and our identification validation service, eApp will ask for verification and prompt for correction, if necessary. If the discrepancy is not cleared up, the agent will be asked to provide proof of identity.

FAQ’s:

Q: How quickly will the communication happen?

A: Prompts will happen within eApp instantly

Q: Will the identification validation service occur on paper applications?

A: Yes, it will occur on all life and annuity business… for paper applications your case manager will run the ID verification manually

Q: What screen/s does this happen on?

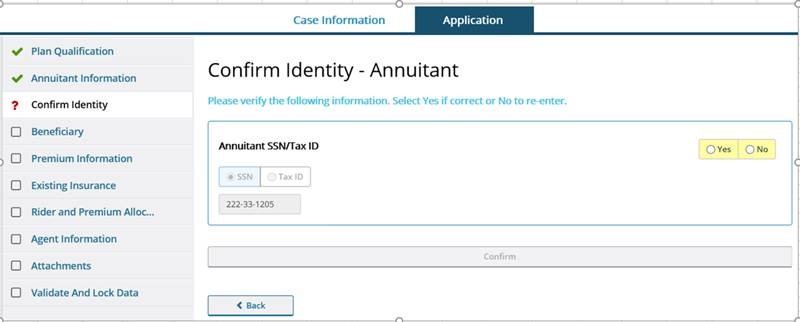

A: The validation will occur after the Primary Annuitant/Insured screen. If there is a need for verification or correction, a new screen ‘Confirm Identity’ will be prompted

Q: How will I know what information doesn’t match?

A: eApp will ask you to verify the client’s information or provide proof of ID (you can do this while still in the application process, to avoid having to go back to the client!). If confirmation is needed, you will be prompted to review the necessary section: