February 13, 2019

Increase Your Sales by 15% – 25%

Increase Your Sales by 15% – 25% in the 403(b)/457(b) marketplace.

The Situation

Your clients want to be comfortable in retirement – confident in their ability to pay bills and have enough left over to do what they enjoy.

Typically, the sources they rely on to fund their retirement are their state retirement plan, social security and personal savings. However, many times clients aren’t aware that there may be a sizeable gap between the actual amount of money that will be in their state retirement plan versus the amount they need to retire comfortably. And they need to make up for this shortfall.

How are they going to save more?

The Opportunity

You can help your clients find additional money by starting with two simple questions:

- “Would you prefer your money go into retirement savings or to the IRS?”

- “How much can you afford to have come out of your paycheck each week to

supplement your retirement savings?

The amount they choose reflects the amount they can give up out of take-home pay.

Using “$500” as the example, then follow these steps to show your client how they can save more for retirement and pay less in taxes.

- Determine your client’s tax bracket

- Using NLG’s marketing tool Save MORE for Retirement. Pay LESS Taxes. Select your client’s tax bracket. (Let’s assume your client is in a 22% tax bracket.)

- Slide down to $500 and note that $500 in take-home pay equals $641 pre-tax.

- Explain that $641 can be deducted from their paycheck and because it comes out pre-tax the entire $641 will go into their retirement savings but their paycheck should only show a $500 reduction in take-home pay.

What might that prospect look like

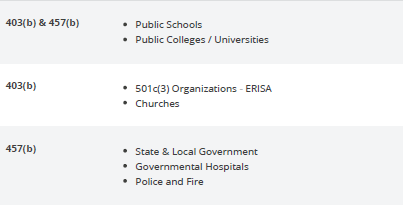

Who is eligible for a 403(b)/457(b)

Start the conversation now:

How much will you need in retirement to live a comfortable lifestyle?

Are you certain that you will have saved that amount?

Let me show you how you can potentially save more money than you thought you could.

Show them the potential shortfall (which can be obtained from state websites or our TRAK software) and then ask how much they could save from their paycheck. Then go through the process

just described above.

Let them know that this is based on their tax bracket assumptions. They will want to monitor the effect to their take-home pay. Ask them to let you know right away if it reduces their take-home by more than they anticipated so that it can be adjusted to match the $500 change they were comfortable with.

Visit the 403(b) Playbook

Anything and everything you want to know about the 403(b) Plan Type at your fingertips with our new playbook! Having this information available at your fingertips makes the buying and selling experience seamless for you and your clients.