February 13, 2019

5 Interest Crediting Options Help Fuel FIT Retirement Series

Register now for index training opportunities directly from Bank of America/Merrill Lynch and Barclays.

Indexing methods are the fuel that powers interest crediting on indexed annuities. While the S&P 500 annual point-to-point method has traditionally been the most popular of our indexing strategies, consumers are looking for more choices and ways to diversify their interest crediting options.

With more crediting options, your customers can choose the fit that they believe will best help them to be FIT…

Financially Independent for Tomorrow.

Monthly Sum Cap S&P 500 — Using the widely known S&P 500 index we assign a number to each month based on the change in the index up to the monthly cap then total all numbers, positive and negative, to calculate the annual interest subject to a zero percent floor.

NEW! — Barclays Low Vol 5 Index — Our exclusive index comprised of 50 value-oriented companies whose stock demonstrates low volatility as determined by Barclays. It uses a Threshold calculation method that allows customers to receive unlimited indexed interest above the Threshold amount.1

NEW! — Bank of America Merrill Lynch GPA Index — Our exclusive diversified index that uses a blend of equities, Real Estate Investment Trusts (REITs) and fixed income that is periodically rebalanced to provide a low volatility index. It offers interest potential provided by high Participation rates with no Cap.1

Moreover, customers can diversify among these three choices, plus our more traditional Annual Point-to-Point S&P 500 Index and Declared Strategy options.

State availability status

Coming to OR on February 25, 2019

Not available in NY

Training Available

Bank of America/Merrill Lynch

February 21st — 4:30 PM ET

Barclays

February 19th — 2:30 PM ET

February 20th — 10:30 AM ET

View the Full Training Calendar to Register

RETIREMENT SOLUTIONS WITH INDEXING

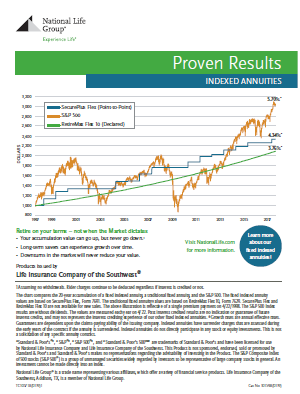

Guaranteed to Never Lose a Penny2

With fixed indexed annuities, principal and interest earned are unaffected by downturns in the market, making them a vital component of a balanced retirement portfolio.

The FIT Retirement Series is designed to help you deliver the best FIT based on the unique needs of each client.

Got Questions?

Visit the FIT Retirement Series Site or Contact National Life Group Sales Desk at 800-906-3310

1 A low volatility index aims to deliver a narrower range of outcomes: more certainty at the expense of less upside and downside. When included in a fixed indexed annuity with the protection of a 0% floor, the benefit of reduced downside will not be realized for index returns below 0%. A cap is not imposed on the indexed interest which can be earned however, the index deducts a maintenance fee to cover expenses, costs and fees. Contract value is not impacted by the maintenance fee. This fee may be increased or decreased in the aggregate by the volatility control mechanism. While the volatility control may result in less fluctuation in rates of return as compared to indices without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls and the Index may underperform similar portfolios from which these fees and costs are not deducted.

2 Assuming no withdrawals during the surrender charge period. Rider charges continue to be deducted regardless if interest is credited or not. The Guaranteed Lifetime Income Rider (GLIR) can be added to an annuity policy at issue and is available on fixed and fixed indexed annuities issued by Life Insurance Company of the Southwest. GLIR may be optional, and may not be available on all products or in all states. Guarantees are dependent on the claims paying ability of the issuing company. Electing this rider incurs an additional cost. Indexed annuities do not directly participate in any stock or equity investments.

TC105986(0119)1