April 25, 2021

Get to Know the 7702 Product Updates

National Life is making enhancements to our product lineup.

What’s changing on May 1 and what remains the same?

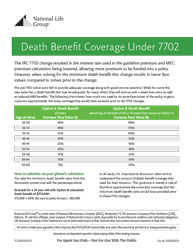

All IUL and UL products will see an increase in premium funding limits as a result of the section 7702 tax code interest rate changes that went into effect at the beginning of the year. Under the new 7702 rules, clients with an interest in cash accumulation potential can benefit from increased funding opportunities beginning May 1, 2021.

For clients who may want to increase their funding in the future, it is important to understand how to add value without diminishing the power of their living benefits. Watch this video to hear from Brittany Russo and Morgan Gold about the upcoming changes.

To help you prepare for the transition, review the product Transition Rules.

For more details on the changes under IRC Section 7702 and their impact, please view the Frequently Asked Questions flyer.