September 11, 2019

Life Insurance That You Don’t Have to Die to Use

Do your clients know the benefits of life insurance while they are still living? Consider this…

One in three consumers are attracted to the flexibility and value of the product, allowing them to address multiple financial risks simultaneously and saving the expenses associated with separate policies. (lifehappens.org)

What a better time than Life Insurance Awareness Month to educate our clients on Accelerated Benefits Riders?

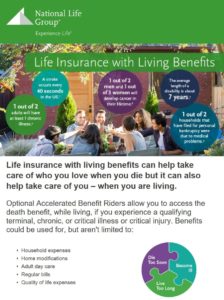

For your clients that need the death benefit protection of life insurance, but are also concerned about their needs while they are living, life insurance with Accelerated Benefits Riders (ABRs)1 or Living Benefits from the insurance companies of National Life Group can provide a safe harbor to help your clients in the event of a qualifying illness or injury. Accelerated Benefits Riders provide a benefit that can be used to pay for anything they choose.² In this case, to pay for medical services not covered, experimental treatments and household bills.

Educate yourself.

Accelerated Benefits Riders Product Guide

View Life Product Quick Reference Chart

Reach out to your clients.

Life Insurance with Living Benefits Consumer Prospecting Email

And educate them.

Living Benefits Consumer Brochure

Living Benefits Consumer Flyer

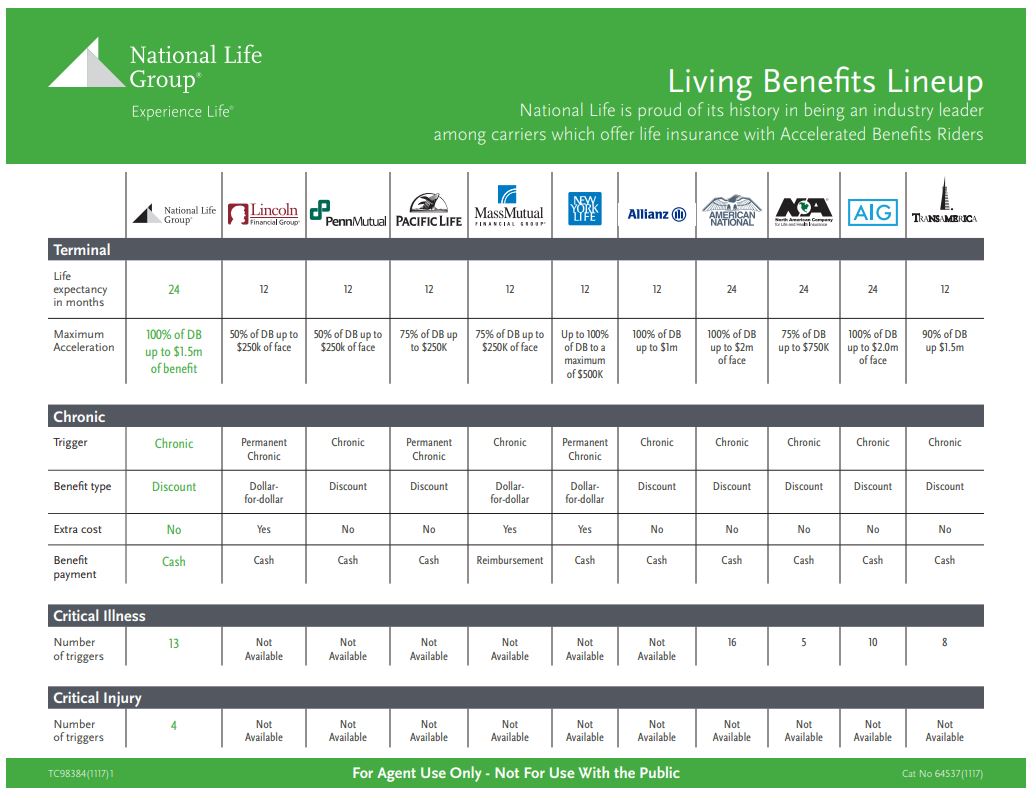

What makes National Life Group stand out in the Sea of Sameness?

Living Benefits Lineup – ABR Comparison Chart

Questions?

Contact your Internal Sales Associate at 1-800-906-3310, option 1.

1 Living Benefits are provided by no additional premium Accelerated Benefit Riders. These riders are optional, and may not be

available in all states or on all products. Receipt of Accelerated Benefits will reduce the Cash Value and Death Benefit otherwise

payable under the policy, may result in a taxable event, and may affect your client’s eligibility for public assistance programs. State

exceptions, limitations and restrictions may apply to riders, benefits and triggers. Refer to the specimen policy forms for the

limitations on these benefits. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless

the client has a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or

on all products.

The use of one benefit may reduce or eliminate other policy and rider benefits.

2. With the exception that ABR proceeds for chronic illness in the state of Massachusetts can only be used to pay for expenses

incurred for Qualified Long-Term Care services, which are defined as the necessary diagnostic, preventative, therapeutic, curing,

treating, mitigating and rehabilitative services, and maintenance or personal care services that are required by a chronically ill

individual and are provided pursuant to a plan of care prescribed by a licensed health care practitioner.

TC109808(0919)1