March 12, 2020

Volatility Controlled Indexes – A Job Well Done

Limiting downward movement due to the recent volatility.

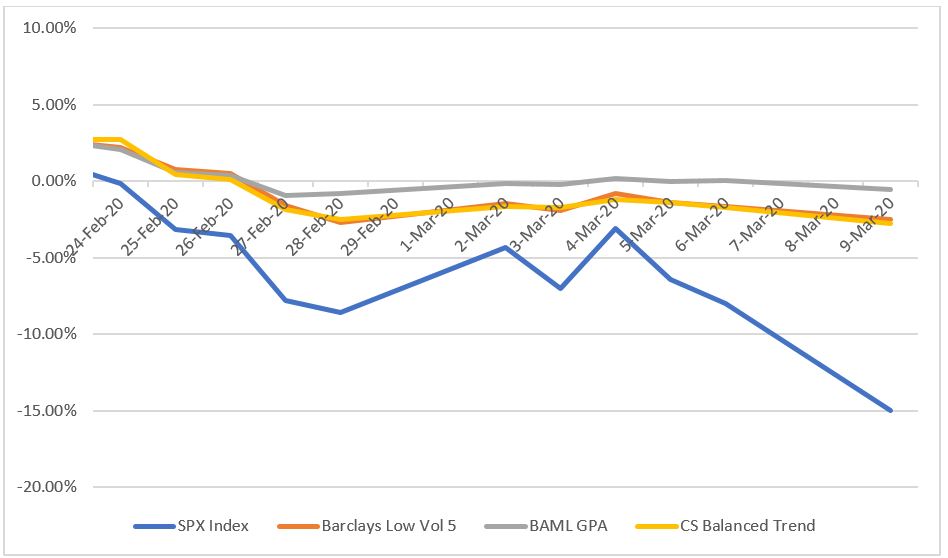

Since the end of February, the Coronavirus has had a profound and dramatic impact on the markets. The S&P 500 has fallen 15% year to date with similar declines in other traditional market indexes.

You may be asking “What about the new indexes on National Life Group products?”

The answer:

They have been doing their job limiting the downward movement due to the recent volatility as you can see in the chart below.

This reduction in downward movement in theory could mean that the time needed to recover is shorter giving the opportunity for more years of positive interest. . . in short, fewer zeros!

You will find these indexes on National Life’s most popular products.

FlexLife and PeakLife:

- Credit Suisse Balanced Trend index

IUL Product Landing Page

IUL Index Landing Page

FIT Secure Growth, FIT Rewards Growth, FIT Certain Income and FIT Select Income:

- Bank of America Merrill Lynch GPA index

- Barclays Low Volatility 5 index

FIT Retirement Series Product Landing Page

Indexed insurance products do not directly participate in any stock or equity investments. When discussing this or other index strategies with your client, explain that this is not an investment in the market and that this is a method for crediting interest and disclose any cap or participation rate that will apply. For an Index with volatility control and additional costs deducted from the Index value, the positive Index value change may be less than that of similar indices that do not include volatility control and do not deduct these costs. This may result in less interest that will be credited. When included in a fixed indexed insurance product with the protection of a 0% floor, the benefit of reduced downside will not be realized for index returns below 0%.