February 19, 2021

Underwriting: Let US Help YOU

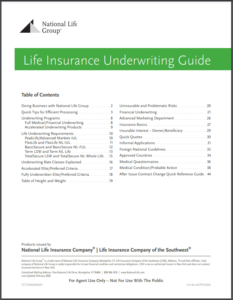

Use our Field Underwriting Guide to get your business processed faster!

At National Life, we have many tools and resources to help you while in the field. Our Life Insurance Field Underwriting guide has information to guide you, whether this is your first time sending an application with us or you are a seasoned agent.

At National Life, we have many tools and resources to help you while in the field. Our Life Insurance Field Underwriting guide has information to guide you, whether this is your first time sending an application with us or you are a seasoned agent.

First, where can you find our comprehensive field underwriting guide? Bookmark the Life Insurance Underwriting Guide for quick access!

In the guide you will find sections on:

- Quick Tips for Efficient Processing

- Underwriting Programs

- Life Underwriting Requirements

- Underwriting Rate Classes explained

- Uninsurable and problematic risks

- Insurable Interest – Owner/Beneficiary

- Foreign National Guidelines

- And so much more!

Below we have highlighted some sections of the guide that we think may be helpful. Please review the complete guide for all the tools and tips you will need to successfully do business with National Life Group!

Common questions missed on an application that are required:

- Has the insured applied for life or disability insurance elsewhere?

- Will the client replace any life insurance coverage inforce?

- Has the insured been convicted of a misdemeanor (including but not limited to DUI or disorderly conduct)

- Name and address of personal physician or name of clinic client last visited. Outcome of the visit.

- NLG requires children ages 0-6 to be seen by a physician on an annual basis. If no physician is seen, NLG will need to reject the file. NLG requires children ages 7-15 to be seen by a physician once every two years. If no physician is seen, NLG will need to reject the file. NLG requires adults age 60 and over to have routine health care and physical within the last 24 months. Otherwise, NLG will need to reject the file.

Some of the common needs for life insurance are as follows:

- Personal Insurance; replacement of income

- Earned income is money received from paid work. It is not income from investments, rental property, alimony, savings accounts etc. Underwriters take into the consideration earned income only. We do not consider SSDI or disability as earned income.

- Juvenile coverage for children ages 0-19: Unless state insurance law dictates otherwise, coverage for juveniles will be considered based on parent or legal guardian’s financial picture up to $1,000,000 or; a death benefit that $100/month on a permanent plan can buy. For larger face amounts on juveniles, underwriting will need additional justification of the coverage applied for.

- Non-Working Spouse: Coverage for non-working spouses would be considered for amounts based on the working spouse’s income and net worth or for an amount a $100/month premium on a permanent plan can buy.

In this section you will find detailed age and amount requirements for our products, also available rate classes and issue ages.

If full testing is a requirement for age and amount or the underwriter asks you to order an exam and labs, one of the following companies must be utilized:

- APPS-Portamedic – www.appslive.com | 516-822-6230

- Exam One – www.examone.com | 877-933-9261

Insurance law and public policy in the various states require that we establish an Insurable Interest between the Proposed Insured and the Owner/Beneficiary exists at the time we issue a life insurance policy. The strictest definition of insurable interest suggests that the Owner/Beneficiary must suffer a quantifiable financial loss at the Insured’s death. In other words, the Owner/ Beneficiary must be better off if the Insured lives rather than dies.

The simplest, most common relationship we insure is that between spouses. Survivor income, debt repayment, tuition costs and final expenses are all quantifiable needs that become readily apparent at death in this situation and are perfectly appropriate purposes for life insurance. Generally accepted Ownership Arrangements include Insured, Spouse, Parent of Minor Child, Grandparent, Business Partner, Business/Corporation Owned by the Insured, and Trusts.

In these sections you will find a height and weight chart with applicable rate classes from Elite to Express 2, conditions that are likely uninsurable or pose a problematic risk, for example uncontrolled diabetes (A1c >10.0) or a history of heart attack in the last 6 months. The last section medical condition and probable action goes over common medical impairments and potential ratings. While the list is not all inclusive you can always reach out to us via Quick Quotes for a tentative quote of insurability (UnderwritingQuotes@NationalLife.com).

As always, feel free to reach out to your Underwriting team via phone call or email for more information and guidance.