March 17, 2020

Your Step-by-Step Guide to Client ID Verification

Together, we can create a smooth and accurate application process ensuring we are able to Deliver on our Promises!

What are we doing?

National Life has implemented an ID Verification process for both life and annuity applications to proactively address personal identification information discrepancies within both our eApp and paper application processes.

Why have we implemented ID Verification?

Protecting policyholder data is of the utmost importance.

With this measure, you can instill confidence in your client that National Life Group takes extreme care with their personal information. We proactively take measures to prevent fraudulent behavior and to ensure the best experience for them throughout the life of their policy. The sooner we can issue their policy, the sooner we can start delivering on our promises!

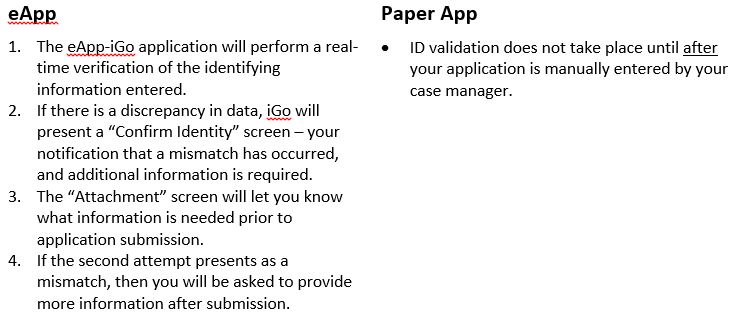

How does it work for eApp vs. Paper App?

How can you proactively avoid discrepancies?

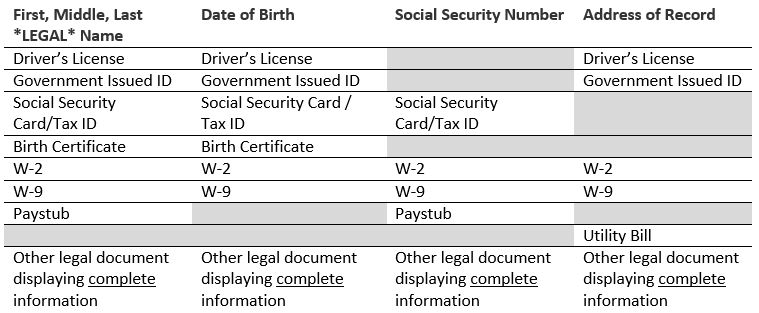

Many times, discrepancies on paper applications arise through simple human error such as inverted numbers, nicknames, a recent change of residence. The following pieces of client identification information are checked against 3rd party validator:

- First, Middle, Last *Legal* Name

- Date of Birth

- Social Security Number/Tax ID

- Address of record

At the time of application, have your clients provide any of the following forms of identification to ensure the accuracy of their information in all four categories. Keep photos/photocopies of their documentation on file should you need to go back for reference (the inverted number!) or provide this documentation to us.

In some instances, particularly where there is more than one discrepancy and the DOB is in question, you may be asked to provide this documentation to us. However, we make every effort to clarify via email or phone.

Only one form of identification is required for each category. Some forms of identification, such as a current Driver’s License, cover more than one category.

Additional tips for a better application experience!

- Getting a copy of documentation can be as easy as taking a photo with your phone and sending into your case manager or attaching to the eApp.

- Write clearly when using paper applications.

This documentation will help ensure a smooth application process and quick resolution of identification discrepancies, should they arise!

What’s next for policyholder protection?

Real-time Banking Validation

eApp – Upfront banking validation will get your cases paid as quickly and accurately as possible. Bank validation will help to prevent errors on bank information and will provide you and your customer a chance to correct a mis-typed bank account and routing number before submitting.

More information coming soon in At Your Service.