September 8, 2022

LIAM: Life Insurance That You Don’t Have to Die to Use

Do your clients know the benefits of life insurance while they are still living? Consider this...

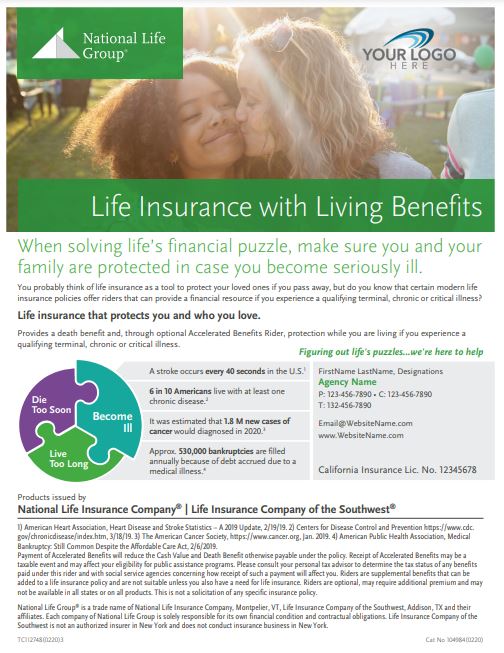

For your clients that need the death benefit protection of life insurance, but are also concerned about their needs while they are living, life insurance with Accelerated Benefits Riders (ABRs)1 or Living Benefits from the insurance companies of National Life Group can provide a safe harbor to help your clients in the event of a qualifying illness or injury. Accelerated Benefits Riders provide a benefit that can be used to pay for anything they choose.² In this case, to pay for medical services not covered, experimental treatments and household bills.

Educate yourself.

Accelerated Benefits Riders Product Guide

Life Product Quick Reference Chart

Reach out to your clients. And educate them.

Make it personal.

Find these Life Insurance with Living Benefits Flyers and more on CoBrand on Demand.

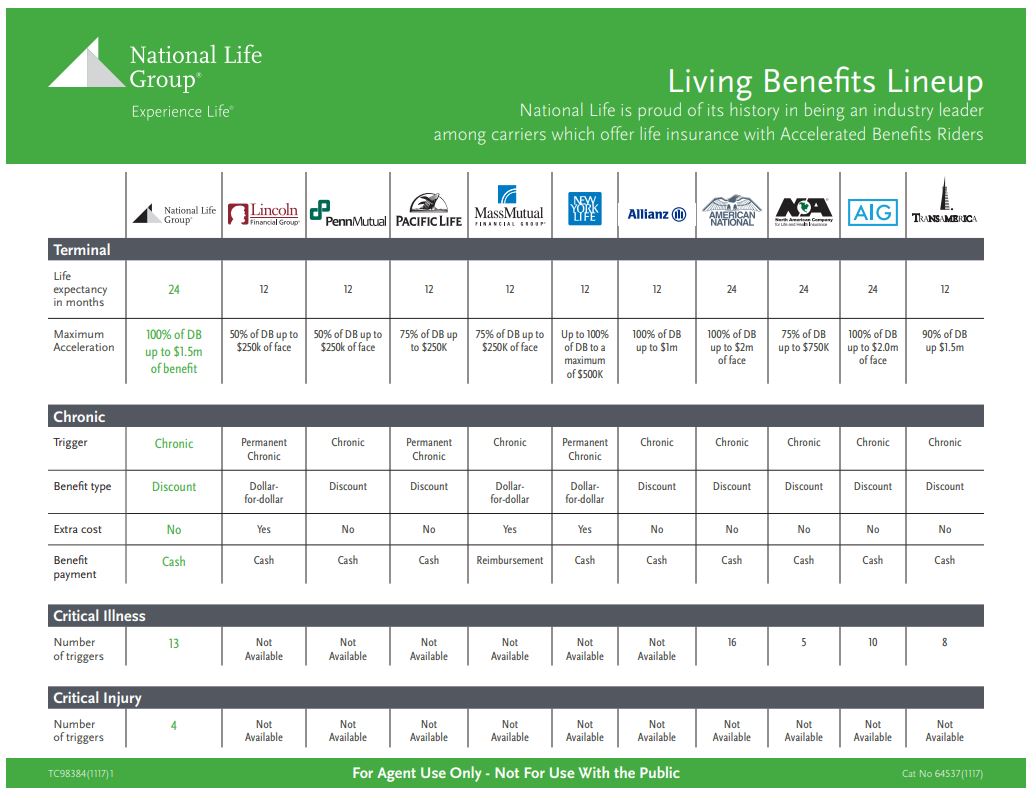

What makes National Life Group stand out in the Sea of Sameness?

Living Benefits Lineup – ABR Comparison Chart

1 Living Benefits are provided by no additional premium Accelerated Benefit Riders. These riders are optional, and may not be available in all states or on all products. Receipt of Accelerated Benefits will reduce the Cash Value and Death Benefit otherwise payable under the policy, may result in a taxable event, and may affect your client’s eligibility for public assistance programs. State exceptions, limitations and restrictions may apply to riders, benefits and triggers. Refer to the specimen policy forms for the limitations on these benefits. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless the client has a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products. The use of one benefit may reduce or eliminate other policy and rider benefits.

2. With the exception that ABR proceeds for chronic illness in the state of Massachusetts can only be used to pay for expenses incurred for Qualified Long-Term Care services, which are defined as the necessary diagnostic, preventative, therapeutic, curing, treating, mitigating and rehabilitative services, and maintenance or personal care services that are required by a chronically ill individual and are provided pursuant to a plan of care prescribed by a licensed health care practitioner.