March 28, 2024

Introducing a New IUL Loan Type!

The Participating Declared Loan (PDL) offers extra upside potential.

National Life Group is excited to announce the launch of a new Participating Declared Loan (PDL) type on March 30 (not available in NY).

A Participating Declared Loan is similar to a Participating Variable Loan, but the loan rate and bonus are set by National Life instead of being tied to an external economic index. This gives us the potential to provide an interest rate that may be steadier than the Participating Variable Loan (PVL) rate.

The new loan type also offers clients the potential to earn more on the loaned amount, thanks to a PDL-specific loan interest bonus.

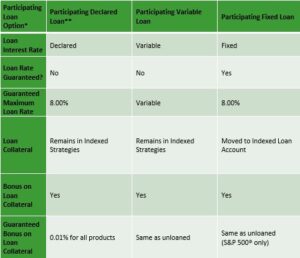

Clients with an IUL policy will be able to choose between four loan types (availability depends on the product):

Participating Declared Loan (PDL) — NEW! (not available in NY)

- Loan collateral is charged a declared loan interest rate, set by National Life Group.

- Maximum loan interest rate: 8.00%.

- Collateral remains in the indexed strategy allocations and continues to earn indexed credits.

- The collateral accumulated value is eligible for a loan interest bonus specific to Participating Declared Loans.

- This loan option is not available for policies where the Enhancer Bonus options have been selected

Participating Variable Loan (PVL)

- Loan collateral is charged a rate that varies with an external economic index (Moody’s Corporate Bond Index). The rate may change on a monthly basis.

- Maximum loan interest rate: 3.00% above the Basic Strategy interest rate (no cap).

- Collateral remains in indexed crediting strategies and continues to earn indexed credits.

- Accumulated Value is eligible for a loan interest bonus, but not the PDL-specific interest bonus.

Participating Fixed Loan (PFL)

- Loan collateral is charged at a fixed interest rate: 5%.

- Maximum loan interest rate: 5%

- Collateral is placed in an Indexed Loan Account, a separate index strategy, where it earns indexed credits.

- Accumulated Value is eligible for a loan interest bonus, but not the PDL-specific interest bonus.

Standard Loan

- Loan collateral is charged a rate that varies with an external economic index.

- Collateral is placed in a Loan Account where it earns fixed interest credits.

- The net loan interest rate equals the interest rate earned in the Indexed Loan Account minus 0.50% in years 1 through 10. Starting in year 11, the interest rate charged and the interest rate earned are identical.

- Accumulated Value is not eligible for any loan interest bonuses.

- Depending on the product, not all loan types may be available.

**Not available in NY

Which loan type clients may prefer depends on a few factors, including:

- Current loan interest rates

- Current bonus rates (available for participating loans only)

- Interest rate trends

- Personal risk preferences — how risk averse clients are and how much they want to take advantage of potential bonuses

- Whether clients prefer a loan based on a market index or one set by National Life Group

Log in to the agent portal on March 30 and check the National Life Group Illustration System to see how this new default loan type option compares to other loan types.