January 8, 2025

Dollar Cost Averaging and SPDAs

4 Reasons to use DCA.

Did you know that National Life Group is currently the only company that offers the option to use Dollar Cost Averaging with Single Premium Indexed Annuities?

4 Reasons Why Clients May Want to Use DCA

Not putting all eggs in one basket

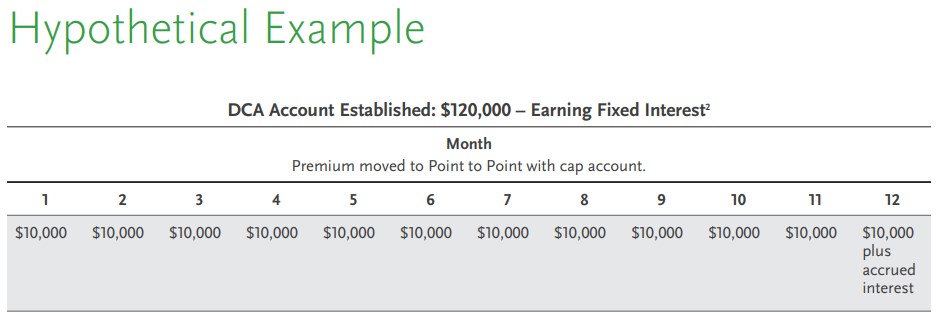

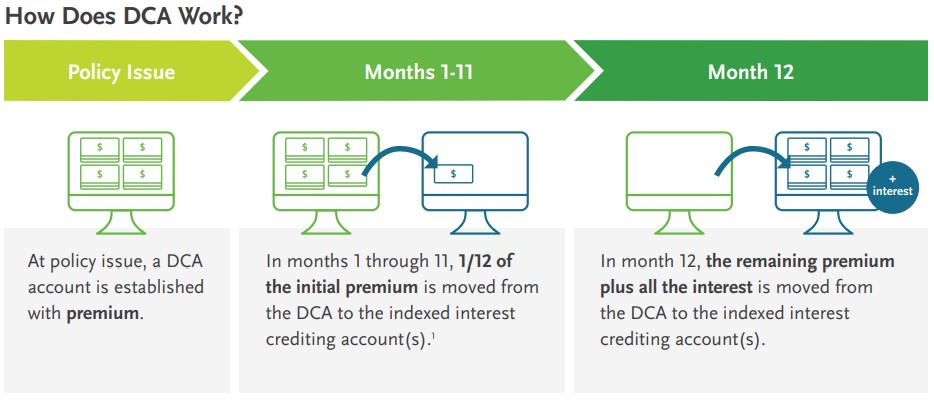

Clients who are concerned about having their yearly interest credited based on a single day may be interested in Dollar Cost Averaging, which provides freedom from one-day crediting. Spreading your premium over a 12-month period means there are 12 crediting dates, instead of just one.

Clients can choose to have all or as little as $5,000 of their premium in the DCA.

Reducing the impact of market volatility

Because there are multiple crediting dates with potentially different interest rates, DCA lowers the risk of poor timing and market fluctuations may have less impact. However, it’s important to note that DCA does not guarantee better results than not using DCA.

The interest rate that your client’s money will get when moved into the indexed interest crediting account(s) will be the rate in effect for that month. That rate may be higher or lower than the rate at policy issue.

Enjoying guaranteed fixed interest during the first year

Funds not yet allocated to an interest crediting strategy continue to earn fixed interest, guaranteeing growth during the first year.

Having the ability to terminate DCA at any time

Clients are not committed to the DCA for the full 12 months. They can request at any time to have the balance of the DCA account moved into interest crediting accounts on the next available move date for their policy.