December 19, 2024

Give the Gift of an Annual Review

It's a gift that gives back all year round.

Conducting an annual review with your current clients provides the opportunity to stay top of mind, provide a value-add service, and ensure your clients coverage aligns with their evolving needs. Below are steps that successful agents use when conducting annual reviews.

Review policy and coverage changes.

- Evaluate current coverage. Review the client’s current policy to confirm it still meets their needs.

Tip: Current coverage and policy values are available in your agent portal.

- Ask about major life changes. Has the client experienced a change such as a birth/adoption of a child, marriage, home purchase or sale, or a change in income.

- Review current beneficiaries and make any changes if needed.

Assess policy performance.

- Review policy growth. For permanent policies, review cash value growth, dividends or interest accumulation.

Tip: Refer to the latest Annual Statement and any Interest Crediting Statements. These are available in your agent portal.

- Discuss premium payments, and any outstanding loans. Re-evaluate premium payments and outstanding loans to make sure they are manageable and align with any financial changes. For a life insurance policy, the impact of premium changes and loans on a policy’s performance can be seen by running an inforce illustration.

Tip: Inforce illustrations are on the same software as sales illustrations for policies issued after October 2016. This is available in your agent portal with training videos.

Identify new needs and new sales opportunities.

- Identify new needs and additional sale opportunities.

- Identify needs for additional coverage such as face increase on a current policy, new purchases such as juvenile policies, or a 401k/403b that could be rolled over.

- For term policy holders discuss conversion options, Review the conversion period and benefits of converting to a permanent policy.

Tip: Term conversion periods are available in your agent portal under the policy information.

Set clear next steps.

- Provide a summary. Recap key points discussed during the review and review recommendations. Follow up with an email including this information.

- Set follow up actions. Outline any steps for policy adjustments and discuss timing.

- Schedule the next review. Depending on the action items, the next review may be sooner than a year out.

- Ask for introductions. Start by asking to meet their beneficiaries and emergency contacts to explain the benefits of the policy, and how to access them. As an agent, you can have a vital role in helping families navigate the claims process.

- Turn your customer into client for life. Stay in touch between now and the next review. Send a message on their birthday and other important milestones. Share appropriate financial articles that are pertinent to their life circumstances.

By structuring annual reviews with these action points, you can enhance the value you bring to your client as a trusted financial professional.

Not sure where to begin?

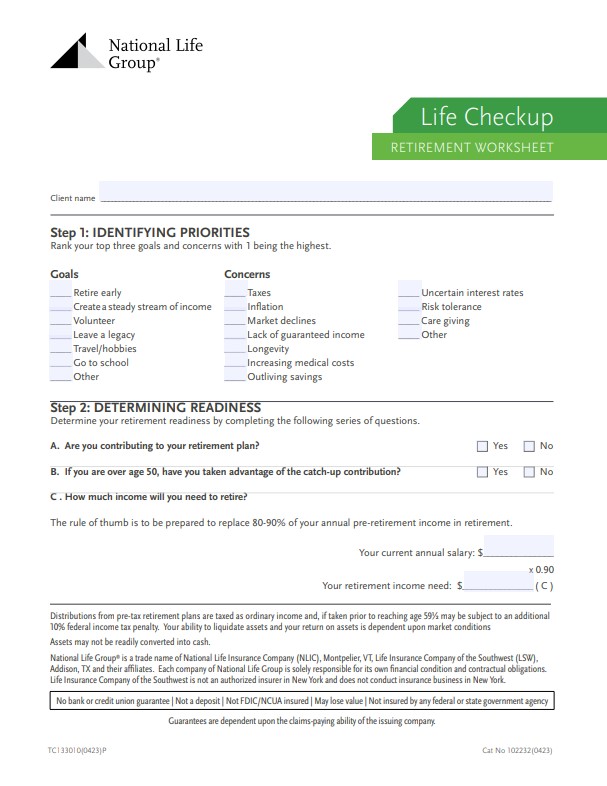

Click below to access our life checkup fact finders.