October 29, 2024

Deadlines for Your 2024 Application Processing

Here's how you can make certain your business is processed in time.

As the fourth quarter of 2024 is underway, National Life Group wants to enable agents to be well equipped and have the best year-end experience possible. Check out the resources below for everything you need to know to finish the year strong!

Holiday Closures

Thursday & Friday, Nov 28 & 29

Office closed for All Employees.

Wednesday, Dec 25

Office closed for All Employees.

Wednesday, Jan 1

Office closed for All Employees.

Important Deadlines

As the fourth quarter of 2024 is underway, National Life Group wants to enable agents to be well equipped and have the best year-end experience as possible. Check out the resources below for everything you need to know to finish the year strong!

Friday, November 1

- Annuity policies with an external 1035 Exchange needed for year-end must be approved and in good order to allow adequate time for funds to transfer from the replaced carrier.

Friday, November 15th

- Life policies with an external 1035 Exchange needed for year-end must be approved and in good order to allow adequate time for funds to transfer from the replaced carrier.

Friday, November 22

- Premium Finance applications should be approved and in good order to allow adequate time for funding.

Friday, December 6

- New Business paper applications must be received and in good order

- Final Rewrite requests must be received and in good order

- Final Underwriting requirements must be received

- Pension/Profit Sharing Plan applications must be received in good order

Friday, December 13

- Final Requirements on any pending cases in approved status

- Final plan designs submitted for Pension/Profit Sharing Plans

Friday, December 20

- New Business eApps that are requested for year end

Friday, December 27

- All annuity applications with money will be issued if received by 12/29

Reminder: Initial payments which cause a MEC on a policy will have premium up-to the non-MEC limit applied at the time of issue. The balance of the premium is not applied until the signed MEC letter is received indicating customer acceptance. Exceptions cannot be granted. To ensure the full premium is applied prior to 12/31/2024, make sure your customer has accepted the MEC and signed and dated the letter promptly.

To make time-sensitive disbursement requests before year-end:

Any Life or Annuity policy disbursement request (including required minimum distributions) received by the Home Office after Friday, December 13 may not be processed prior to year-end. In order to ensure processing within the 2024 tax year, please submit to disbursement requests in advance of this date.

- Year End Quick Reference Guide: This guide is your one-stop shop for information and tips related to New Business and Underwriting, as well as useful contact information.

- Best Practices to Increase Auto Decisions: By following these suggestions, cases are likely to stay within the underwriting engine for Straight Through Processing (instant approval). Otherwise, when referred to an Underwriter, the case can be delayed, potentially taking up to an additional 5 – 7 days to be reviewed by an Underwriter for a decision.

- Agent Mobile App: Save time and manage your business on-the-go, anytime!

Important Year-end Dates

Deadline for Term Conversion Applications to be issued and paid in 2024

- Friday, December 6: Term conversions requiring underwriting due to additional riders or an increase in coverage must be received in good order.

- Monday, December 16: Deadline for Term Conversions submitted on a paper application to be issued and paid in 2024, must be received by end of day and be in good order.

- Monday, December 23: Term Conversions submitted via eApp to be issued and paid in 2024 must be received by end of day and be in good order.

- Note: If the conversion requires underwriting the deadline is 12/6.

Important Tips for submitting Term Conversions:

- Use eApp for Term Conversions.

- Please include an illustration with all Term Conversions to ensure the new policy is issued correctly.

- Thursday, November 21: Cutoff for deposit on Tuesday, November 26.

- Tuesday, November 26, cutoff for deposit on Tuesday, December 3 (the change from Thursday to Tuesday due to the holiday week).

- Thursday, December 26 cutoff for deposit on Tuesday, December 31 (Note – this is the last commission cutoff for tax year 2023).

* Remember to update your mailing address within the Commissions Payment Portal so tax statements (1099s, W2s, W2Ss) are sent to your desired address.

Thursday, Nov 28

Office closed for All Employees.

Friday, Nov 29

Office closed except those critical to trading and variable products. ESI: The equity markets are open until 1pm. ET and bond markets until 2p.m. ET. CEC and Sales Desk closed.

Tuesday, Dec 24

ESI: The equity markets are open until 1p.m ET and bond markets until 2p.m. ET.

Wednesday, Dec 25

Office closed for All Employees.

Tuesday, Dec 31

ESI: The equity markets are open until 1p.m. ET and bond markets until 2p.m. ET.

Wednesday, Jan 1

Office closed for All Employees.

eDelivery is the primary policy delivery method for all Life and Annuity policies issued by National Life. Conducting policy eDelivery is fast, simple and can be incredibly convenient for both you and your client.

DocuSign provides a safe, familiar, and reliable experience for you and your client. And you can easily review and approve policies, view status, and receive updates as your client completes eDelivery.

Using DocuSign eDelivery for the first time may require some explanation. Please refer to the guide below for instructions and answers to some of the most frequently asked questions.

Getting started

The following information is required to conduct policy eDelivery:

- The primary agent’s email address

- The policy owner or annuitant’s email address

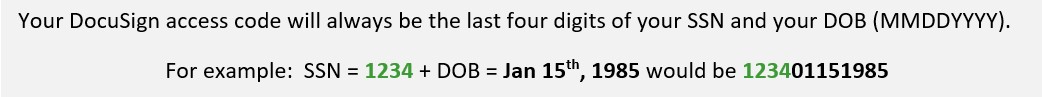

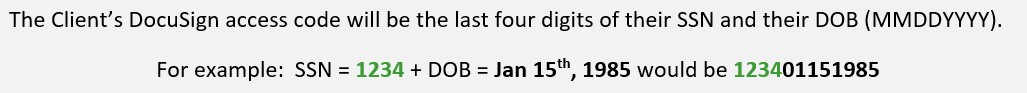

- The Document access code comprised of the contacts last four digits of SSN and date of birth (including zeros)

How it works

- For life and annuity polices that are issued with a lump sum payment, the primary agent will be notified to review, sign and approve the policy. Upon completion, the document will be sent to the client to complete their signature and approval process.

- For Annuity policies issued with a recurring payment (flow only), the policy will be sent directly to the client with a copy sent to the primary agent. No agent action is required.

Note: All eDelivery messages are sent systematically from Policy@docs.nationallife.com (This is a NO REPLY address)

Steps to complete eDelivery

Completing eDelivery is simple and convenient for you and your client as shown in the example below.

Step 1: Receive email notification with a link to the policy documents as shown below.

Note: All eDelivery messages are sent systematically from Policy@docs.nationallife.com and neither you nor your clients need to have an existing DocuSign account in order to review or sign documents.

Step 2: Click to access the document online. You’ll be prompted to enter your custom access code.

Step 3: Review, sign and approve or decline. Upon approval, the policy will be forwarded to the client.

Step 4: Client receives notification email with link to the policy documents. Click to review and sign.

Step 5: Order a National Life Policy Promise to be sent directly to your client or receive it yourself and make arrangements to hand deliver the Promise in your next client meeting.

Hint: To receive status notifications, sign-up for New Business SMS alerts via the Agent Portal or Mobile App.

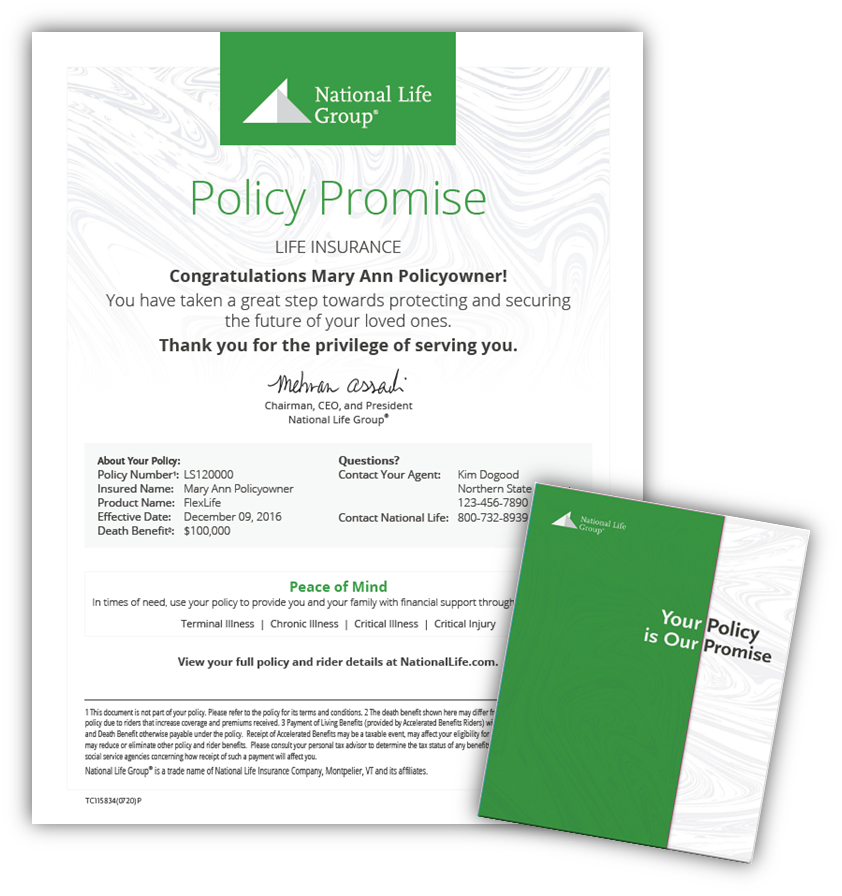

The Policy Promise: Helping you create Peace of Mind at delivery

eDelivery is fast, convenient and ensures that all form signatures are completed and returned quickly. While the full policy is available to you and your clients online any time, some clients may benefit from a more tangible policy delivery experience, especially if you are delivering the policy in person.

National Life has introduced the Policy Promise to help you engage your clients through eDelivery and to create a lasting impression that will support your long term client relationship. Unique to National Life and exclusive to eDelivery, the Policy Promise is a keepsake document for your clients to represent the value and benefits of their National Life policy.

- Access the Policy Promise for your new clients in the Agent Portal or Mobile App

- Download and print yourself or order the Policy Promise to be printed and mailed

- Send directly to your client from National Life after eDelivery is completed or receive it yourself and bring the Promise to your next client meeting

- The Policy Promise is also available to your clients online

When ordered by mail, the Promise is printed on quality stock paper and packaged in a custom folder.

Sample Life Insurance policy promise and custom Policy Promise folder.

We’re here to help.

Contact us at agentweb@nationallife.com

We want to help you end the year strong and ensure your experience with National Life Group is the best possible.