July 30, 2024

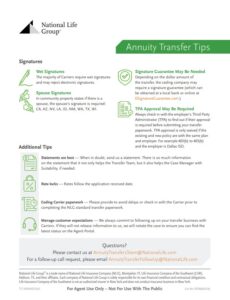

Annuity Transfer Tips

A few things to keep in mind.

Many clients have multiple retirement savings accounts at different companies. When they buy a Single Premium Deferred Annuity (SPDAs), like Income Driver or Zenith Growth, they often ask if they can transfer money from multiple accounts into the SPDA. (Learn more about SPDAs.)

At National Life, that’s no problem! We allow up to 90 days for additional premiums to be transferred after the policy is issued.

A few things to keep in mind:

- A direct transfer or rollover is always the best method for transferring money. An indirect rollover, where the policy owner gets money from the other carrier and then sends it to us, could result in 20% withholding and a taxation penalty if we do not receive the funds within 60 days.

- Check the Transfer/Rollover Chart to make sure all money transferred has the same tax qualification.

- Clients cannot mix qualified money with non-qualified money.

- Additional premiums are swept into the indexing account on the same sweep date (e.g., every month on the 7th) as the first premium.

- The policy is issued showing the initial premium and won’t reflect additional premiums. Clients can see the total premium deposited in the client app and online client portal.

Questions? Contact AnnuityTransfersTeam@NationalLife.com. For a follow-up call request, please email AnnuityTransferFollowUp@NationalLife.com.

Learn More About Annuity Transfers