November 4, 2021

Year-end Tips and Tricks for Smoother Processing

Here's how you can make certain your business is processed in time.

As the fourth quarter of 2021 is underway, National Life Group wants to enable agents to be well equipped and have the best year-end experience as possible. Check out the resources below for everything you need to know to finish the year strong!

To view helpful tips, please view the quick reference guides we have developed for your convenience:

To view helpful tips, please view the quick reference guides we have developed for your convenience:- Year End Quick Reference Guide: This guide is your one-stop shop for information and tips related to New Business and Underwriting, as well as useful contact information.

- Tips and Reminders from the Payment Center: Use this guide for information regarding premium payments and disbursement requests.

- Best Practices to Increase Auto Decisions: By following these suggestions, cases are likely to stay within the underwriting engine for Straight Through Processing (instant approval). Otherwise, when referred to an Underwriter, the case can be delayed, potentially taking up to an additional 5 – 7 days to be reviewed by an Underwriter for a decision.

- Agent Mobile App: Save time and manage your business on-the-go, anytime! The App is now a complete selling and servicing tool, making it even easier to do business 24/7.

Reminder:

As previously announced, it is strongly recommended that business requiring 1035 funds to pay initial premium be submitted by 10/25. Please note, we will still accept it after the 25th, but slower turnarounds from ceding carriers may make it difficult to pay the case for year-end.

View Important Year-end Dates

Monday, November 29

- Premium Finance applications should be approved and in good order to allow adequate time for funding.

Friday, December 10

- Final requirements on new business applications must be received and in good order to be finalized for year-end.

- Final underwriting requirements must be submitted.

- Rewrite requests must be received and in good order.

- Pension/Profit Sharing Plan applications must be received and in good order.

- Any Life or Annuity policy disbursement request (including required minimum distributions) received by the Home Office after Friday, December 10 run the risk of not being processed prior to year-end. In order to ensure processing within the 2021 tax year, please submit disbursement requests in advance of 12/10/2021.

Friday, December 31

- All annuity applications with money will be issued if received by 12/31.

- In order to receive the current TotalSecure product, policies must be issued by 12/31/2021.

- As such, applications must be submitted by 12/10/2021.

NOTE: Term conversions into IUL and UL products can be submitted via eApp. Term conversions into TotalSecure must be submitted via paper. Include an illustration with all Term Conversions to ensure that the new policy is issued correctly.

- Term conversions submitted via eApp: received by noon on December 28.

- Term conversions submitted via paper: received by December 21.

- Term conversions that require underwriting: all requirements received by December 10.

Life and Annuity

- Tuesday, November 23

- Wednesday, December 22

- Thursday, December 30- last commission run of the year

* Remember to update your mailing address within the Commissions Payment Portal so tax statements (1099s, W2s, W2Ss) are sent to your desired address.

Wednesday, Nov 24

Office closed except those critical to trading and variable products.

Sentinel/ESI: the equity and bond markets are open as usual. As such ESI must staff for any client trades or money movement requests that day. Reduced staff until markets close.

CEC and Sales Desk are closed. For customers wishing to transact allocation changes or transfers on Variable Products during trading hours please leave a message at 1-800-732-8939 or email lifebilling@nationallife.com with your instructions.

Thursday, Nov 25

Office closed for All Employees.

Friday, Nov 26

Office closed except those critical to trading and variable products.

Sentinel/ESI: the equity markets are open until 1p ET and bond markets until 2 p.m. ET. As such ESI must staff for any client trades or money movement requests that day. Reduced staff until 2p ET.

CEC and Sales Desk are closed. For customers wishing to transact allocation changes or transfers on Variable Products during trading hours please leave a message at 1-800-732-8939 or email lifebilling@nationallife.com with your instructions.

Thursday, Dec 23

Office closed except those critical to trading and variable products.

Sentinel/ESI: the equity markets are open as usual, the bond markets close early at 2 p.m. As such, ESI must staff for any client trades or money movement requests that day. Reduced staff until markets close.

CEC and Sales Desk are closed. For customers wishing to transact allocation changes or transfers on Variable Products during trading hours please leave a message at 1-800-732-8939 or email lifebilling@nationallife.com with your instructions.

Friday, Dec 24

Office closed for All Employees.

Monday, Jan 3

Sentinel/ESI: the equity and bond markets are open as usual. As such ESI must staff for any client trades or money movement requests that day. Reduced staff until markets close.

CEC and Sales Desk are closed.

eDelivery is the primary policy delivery method for all Life and Annuity policies issued by National Life. Conducting policy eDelivery is fast, simple and can be incredibly convenient for both you and your client.

DocuSign provides a safe, familiar, and reliable experience for you and your client. And you can easily review and approve policies, view status, and receive updates as your client completes eDelivery.

Using DocuSign eDelivery for the first time may require some explanation. Please refer to the guide below for instructions and answers to some of the most frequently asked questions.

Getting started

The following information is required to conduct policy eDelivery:

- The primary agent’s email address

- The policy owner or annuitant’s email address

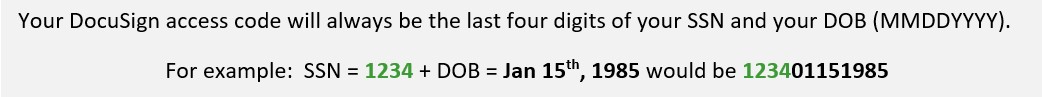

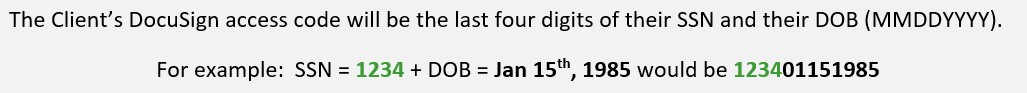

- The Document access code comprised of the contacts date of birth and last four digits of SSN

How it works

- For life and annuity polices that are issued with a lump sum payment, the primary agent will be notified to review, sign and approve the policy. Upon completion, the document will be sent to the client to complete their signature and approval process.

- For Annuity policies issued with a recurring payment (flow only), the policy will be sent directly to the client with a copy sent to the primary agent. No agent action is required.

Note: All eDelivery messages are sent systematically from Policy@docs.nationallife.com

Steps to complete eDelivery

Completing eDelivery is simple and convenient for you and your client as shown in the example below.

Step 1: Receive email notification with a link to the policy documents as shown below.

Note: All eDelivery messages are sent systematically from Policy@docs.nationallife.com and neither you nor your clients need to have an existing DocuSign account in order to review or sign documents.

Step 2: Click to access the document online. You’ll be prompted to enter your custom access code.

Step 3: Review, sign and approve or decline. Upon approval, the policy will be forwarded to the client.

Step 4: Client receives notification email with link to the policy documents. Click to review and sign.

Step 5: Order a National Life Policy Promise to be sent directly to your client or receive it yourself and make arrangements to hand deliver the Promise in your next client meeting.

Hint: To receive status notifications, sign-up for New Business SMS alerts via the Agent Portal or Mobile App.

The Policy Promise: Helping you create Peace of Mind at delivery

eDelivery is fast, convenient and ensures that all form signatures are completed and returned quickly. While the full policy is available to you and your clients online any time, some clients may benefit from a more tangible policy delivery experience, especially if you are delivering the policy in person.

National Life has introduced the Policy Promise to help you engage your clients through eDelivery and to create a lasting impression that will support your long term client relationship. Unique to National Life and exclusive to eDelivery, the Policy Promise is a keepsake document for your clients to represent the value and benefits of their National Life policy.

- Access the Policy Promise for your new clients in the Agent Portal or Mobile App

- Download and print yourself or order the Policy Promise to be printed and mailed

- Send directly to your client from National Life after eDelivery is completed or receive it yourself and bring the Promise to your next client meeting

- The Policy Promise is also available to your clients online

When ordered by mail, the Promise is printed on quality stock paper and packaged in a custom folder.

Sample Life Insurance policy promise and custom Policy Promise folder.

We’re here to help.

Contact us at agentweb@nationallife.com

We want to help you end the year strong and ensure your experience with National Life Group is the best possible.