October 23, 2019

Annual life checkup can help the conveyor belt run smoothly

Keep on top of your clients’ ever-changing life insurance needs

Insufficient coverage has grave consequences for countless families.

By conducting an annual “Life Checkup” with your clients, you can uncover their ever changing life insurance needs. And help them be prepared for when “Life Happens.” Consider this…

The increased need for life insurance is not a foreign concept to many of your clients. Many are already aware of their deficiency. According to LIMRA, people procrastinate getting the life insurance they know they need. They come up with a lot of excuses, including 61% who say they have “other financial priorities.”

Take the initiative.

Conducting a life checkup may provide your clients the peace of mind of learning that their life insurance is sufficient for their goals. You might also help them identify a gap in coverage, and some solutions to help ensure they meet their lifelong dreams. Customize the checkup to reflect their particular needs. Make them aware of riders available to provide protection for the client and their family if they should die too soon, become ill or injured or are concerned they may outlive their retirement income.

Ask your clients if they recently…

- Purchased a new home

- Had a baby or adopted a child

- Had a death in the immediate family

- Received an inheritance

- Started planning for college savings

- Married or divorced

- Purchased or sold a business

- Became an empty nester

- Received an increase in income

- Needed supplemental retirement funds

We have resources to help you stay in touch with clients, review their life insurance needs and help them protect what matters most.

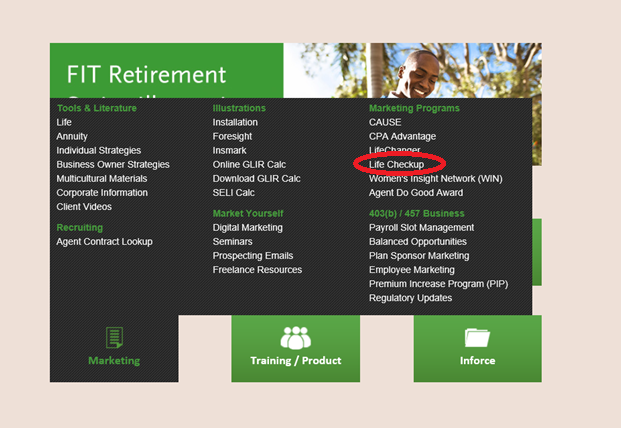

How to access the Life Checkup resource page:

Log into www.NationalLife.com

Go to Marketing>> Marketing Programs >>Life Checkup or click here.

Other resources to conduct your client’s life checkup

- National Life Group offers a Life Insurance Checkup Kit available under the Forms and Materials search on your Agent Portal. This provides you with everything you will need from gathering the clients personal information to steps that you can follow to make sure you are covering all of your clients needs during the life checkup meeting.

The ability of a life insurance contract to accumulate sufficient cash value to meet accumulation goals will be dependent upon the amount of extra premium paid into the policy, and the performance of the policy, and is not guaranteed. Policy loans and withdrawals reduce the policy’s cash value and death benefit and may result in a taxable event. Surrender charges may reduce the policy’s cash value in early years.

Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless the client has a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products.