August 31, 2022

LIAM: When Was the Last Time You Conducted a Life Checkup with Your Clients?

An annual "Life Checkup" can uncover your clients' ever changing life insurance needs.

Insufficient coverage has grave consequences for countless families. By conducting an annual “Life Checkup” with your clients, you can uncover their ever changing life insurance needs. And help them be prepared for when “Life Happens.” Consider this…

The increased need for life insurance is not a foreign concept to many of your clients. Many are already aware of their deficiency.

What does this mean for you?

That it’s up to you to take the initiative.

September is Life Insurance Awareness Month, and a great time for a life checkup.

Conducting a life checkup may provide your clients the peace of mind of learning that their life insurance is sufficient for their goals. You might also help them identify a gap in coverage, and some solutions to help ensure they meet their lifelong dreams. Customize the checkup to reflect their particular needs. Make them aware of riders available to provide protection for the client and their family if they should die too soon, become ill or injured or are concerned they may outlive their retirement income.

Ask your clients if they recently…

- Purchased a new home

- Had a baby or adopted a child

- Had a death in the immediate family

- Received an inheritance

- Started planning for college savings

- Married or divorced

- Purchased or sold a business

- Became an empty nester

- Received an increase in income

- Needed supplemental retirement funds

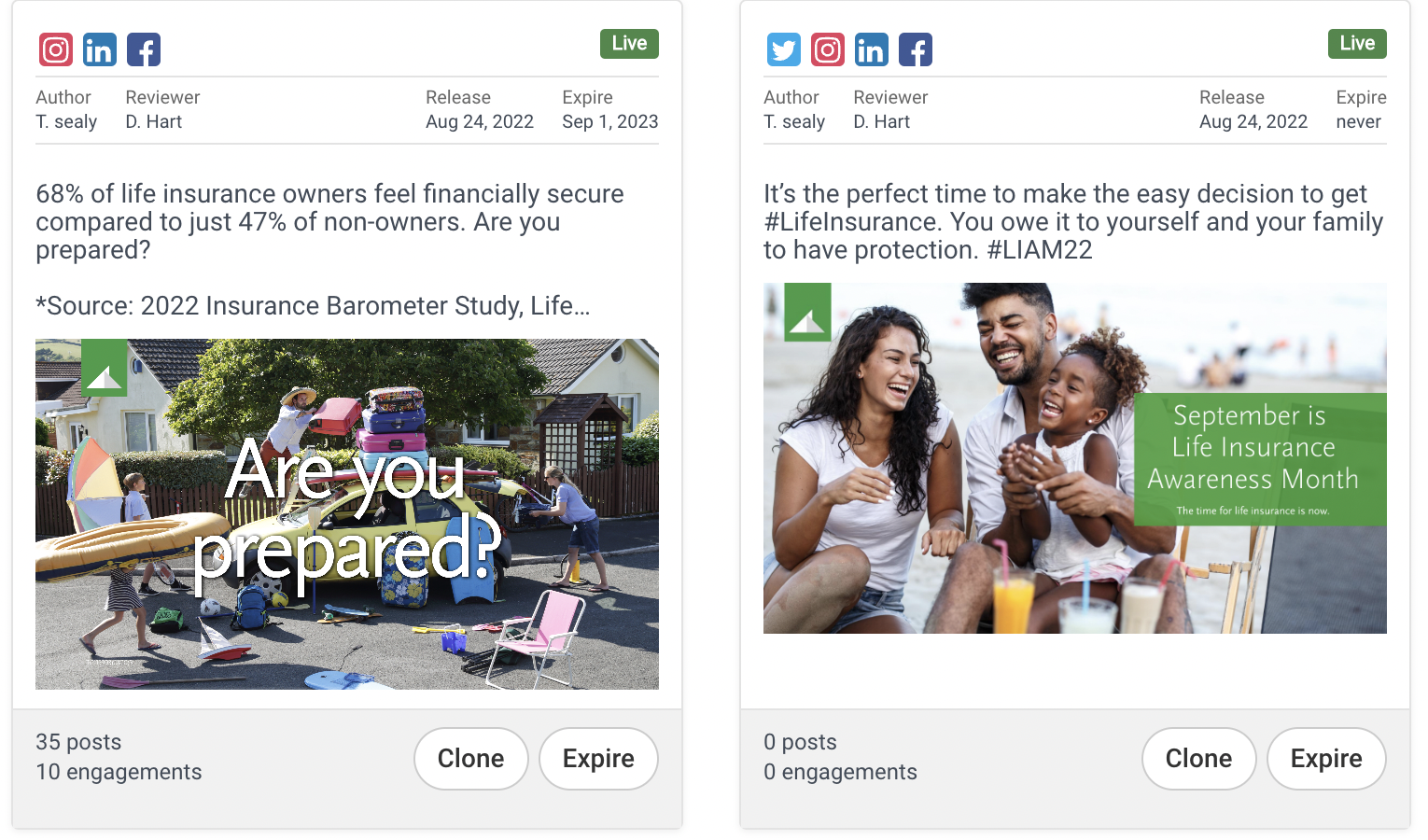

Connect with clients and future customers using the power of social media.

- Affiliated Agents: Please ensure NLG content is only shared through approved social media sites using Hearsay. See the Affiliated Social Media Playbook for how to do this.

- Independent Agents: Review the Social Media Playbook and don’t forget to follow the Do Good. Be Good. Make Good. accounts and share our posts! Facebook, Instagram, LinkedIn and Twitter

Use these resources to stay in touch with clients, review their life insurance needs and help them protect what matters most.

- National Life Group offers a Life Insurance Checkup Workbook. This provides you with everything you will need from gathering the clients personal information to steps that you can follow to make sure you are covering all of your clients needs during the life checkup meeting.

- National Life Group Life Insurance Calculator. Have your clients fill out the tool to determine their coverage needs based on debt, funeral expenses, college funding, and much more.