September 4, 2024

Why Partnering with You is a Smart Choice for Small Business Retirement Planning

Tax credits, choices, no fees, and retirement planning strategies with your guidance and support!

Several states have mandated retirement plan access for employees of small businesses to address the retirement savings gap that many employees face, this has opened NEW markets for annuity sales.

State Legislators are mandating that small business owners provide their employees with a retirement plan or enroll employees in a state-run plan. On average more than 66% of small businesses do not offer retirement benefits to their employees¹– lots of opportunities to help small business owners navigate these new state mandates.

Business owners impacted by these mandates have three choices

- Register with the state, enroll all eligible employees in the state program, set up payroll deductions for each employee, and post regular notices. Program fees vary from state to state. Employees can opt-out after being enrolled.

- Offer one of the following qualified plans and be exempt from the mandate.

– Payroll Deducted IRAs (California only)

– SEP – Simplified Employee Pension 408(k)

– SIMPLE – Savings Incentive Matching Plan for Small Employers 408(p)

– 401(a) – Qualified Plan (including profit-sharing plans and defined benefit plans)

– 401(k) plans (including multiple employer plans or pooled employer plans)

– 403(a) – Qualified Annuity Plan or 403(b) Tax-Sheltered Annuity Plan

- Ignore the mandate and face fines ranging from $100 to $500 per employee not enrolled or exempt.

With so many options, why should a business owner work with you to offer employees a retirement plan?

Tax credits, choices, no fees, and retirement planning strategies – with your guidance and support!

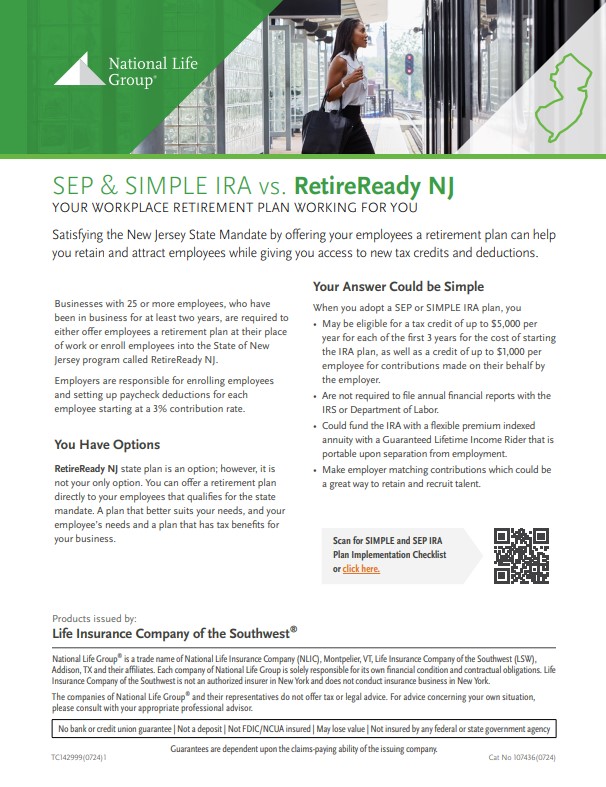

States in which implementation is underway

December 31, 2025 – Deadline for employers with one(1) or more employees.

Fine: $250 per employee

Fine: $100 per employee

Fine: $500 – $1,500 per employee

MyCTSavings

Fine: $250 per employee per year, up to a maximum total penalty of $5,000 per year

Delaware EARNS

Fine: $250 per employee

Fine: $100 per employee

MERIT

MarylandSaves

November 15, 2024 – Deadline for employers with 25 or more employees.

Fine: $250-$500 per employee

Fine: $100 per employee

OregonSaves

July 1, 2025 – Deadline for employers with 25 or more employees.

January 1, 2026 – Deadline for employers with 15 or more employees.

July 1, 2026 – Deadline for employers with five (5) or more employees.

Fine: TBA

VT Sales website not yet live.

Fine: $200 per employee

Subject to enforcement action, which may include financial penalties

States in which legislation is passed and implementation details are forthcoming

Hawaii – Hawaii Saves Retirement Savings Program

Massachusetts – Secure Choice Retirement Savings Plan

Minnesota – Minnesota Secure Choice Retirement Program

New York – Secure Choice Savings Program

New York City – Retirement Security for All Act

Nevada – Nevada Employee Savings Trust

New Mexico – Work and $ave

Rhode Island – Secure Choice Retirement Savings Program

Washington – Retirement Marketplace

National Life has a variety of resources available to assist you in this marketplace.

(Agent Portal login required)

Register for September 10 Training Webinar

Contact us with questions!

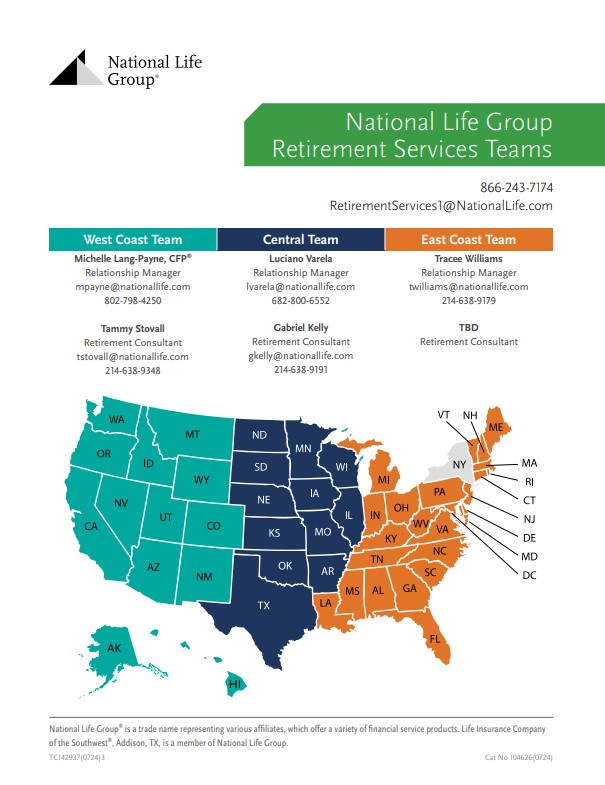

Email National Life Group Retirement Services: RetirementServices1@nationallife.com

Or click on the map below to contact your regional Relationship Manager directly with questions.