August 8, 2024

Unlock Savings with State Mandated Workplace Benefits: SEP & SIMPLE IRA vs. RetireReady NJ

Small businesses could cash in on tax credits and deductible contributions with the SECURE Act!

A Simple IRA plan or SEP IRA plan can provide a simplified way to contribute toward retirement. This retirement plan option is designed to be straightforward and cost-effective, making it particularly appealing to employers looking for a manageable yet impactful way to support their employees’ long-term financial security. In several states, small business owners who do not have an employer-sponsored retirement plan must provide one. Many states are expected to follow.

Most small business owners think the only option is a 401(k), which can be expensive and complicated to set up. Talk with them about the Simple IRA and SEP IRA options provided by the IRS specifically for small businesses seeking a low-cost plan that’s easy to administer and maintain.

Spot the Opportunity

- SEP IRA (Simplified Employee Pension IRA):

- Designed for small businesses and self-employed individuals.

- Employers contribute to employees’ SEP IRAs, limited to 25% of each employee’s salary or $69,000 (whichever is lower) annually in 2024.

- SIMPLE IRA (Savings Incentive Match Plan for Employees):

- Designed for small businesses with less than 100 employees.

- Employers can match employee contributions or make non-elective contributions of up to 3% of eligible employees’ compensation.

- Employees can contribute up to $16,000 annually (as of 2024).

Plus, in states that require businesses to have a retirement savings plan, these are very cost-effective options!

Conversation Starters & Marketing Materials

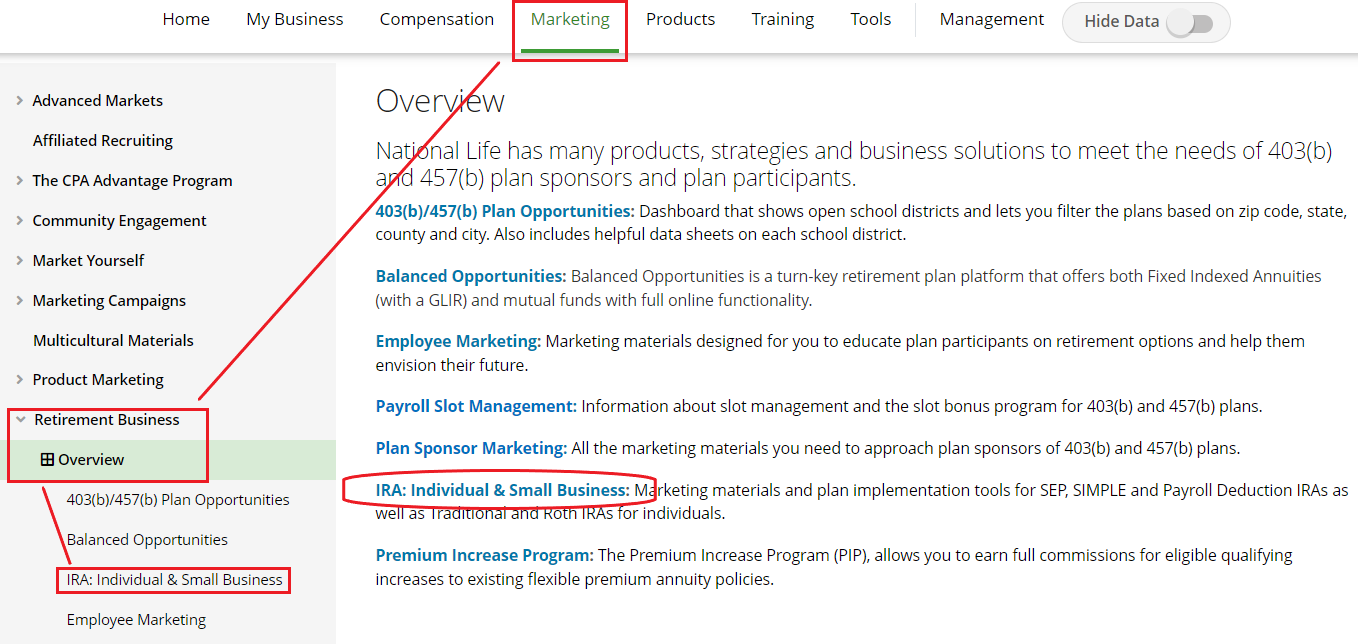

In an environment that is challenging to attract and retain high-quality talent, a SIMPLE IRA may be just the alternative some employers are looking for to provide a more employee-centric and customized retirement plan. To navigate from the Agent Portal homepage, go to Marketing > Retirement Business > IRA: Individual & Small Business

IRS Retirement Topics – Automatic Enrollment

Which states have mandatory retirement plans?