July 24, 2024

The Answer, My Friend, Is No Longer Blowin’ in the Wind

IRS clarifies RMDs under the 10-Year Rule.

On July 19, 2024, the Internal Revenue Service and the Treasury Department published Required Minimum Distributions Final Regulations. The regulations are effective as of September 17, 2024 and reflect changes made by the SECURE Act and the SECURE 2.0 Act.

One long-awaited question that required clarification was if annual required minimum distributions (RMDs) under the 10-Year Rule are mandatory if the original account owner’s death occurred after they were taking RMDs. The answer is YES.

Some Background

The SECURE Act eliminated the ability of a Designated Beneficiary of an inherited account to take distributions over their life expectancy.1 With the SECURE Act, a Designated Beneficiary is required to liquidate the inherited account over a ten-year period after the account owner’s death (10-Year Rule).2 The SECURE Act suggested that the Designated Beneficiary could take distributions as desired for the first nine years.

However, the Proposed Regulations issued in 2022 required the Designated Beneficiary to take annual RMDs over the 10-Year period if the original account owner was taking RMDs3 and died after December 31, 2019.

Due to the inconsistency between the SECURE Act and the Proposed Regulations, the IRS waived RMDs under the 10-Year Rule for years 2020 through 2023 and again for 2024.4

Going Forward

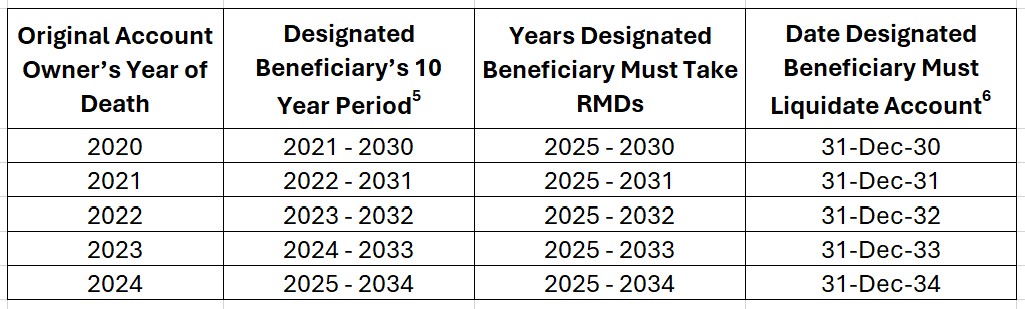

What does this mean for Designated Beneficiaries subject to the 10-Year Rule who inherited an account between 2020 and 2024 from the original account owner whose death occurred while taking RMDs?

Summary

- RMDs under the 10-Year Rule only apply to Designated Beneficiaries of an inherited account if the original account owner’s death occurred after they were taking RMDs.

- If the original account owner’s death occurs prior to taking RMDs, the Designed Beneficiary is not required to take any RMDs during the first nine years.

- All Designated Beneficiaries must liquidate the inherited account by the end of the tenth year.

Your Next Steps

- Schedule a meeting with clients to review their beneficiary designations to help ensure coordination with their overall estate plan.

- Discuss options with clients to enhance their legacy, such as the Legacy IRA Strategy. For more information see our Legacy IRA Strategy agent brochure and customer flyer.

- Contact clients who recently inherited an account to inform them of this regulatory change. For more information see our Setting Up an Inherited Account – Withdrawal Options for the Beneficiary agent guide.

- Watch this brief video. Also available on YouTube.

You have direct access to Advanced Sales for case consultation and point-of-sale support.

Need Help?

Contact us at 1-800-906-3310, option 1.

On the Agent Portal, look for this icon under Tools on the right sidebar.

[1] A Designated Beneficiary is a beneficiary who is not the spouse or minor child of the deceased account owner; disabled or chronically ill individual; an individual who is not more than 10 years younger than the account owner. [2] The 10-Year Rule applies to the original Designated Beneficiary, not a successor beneficiary. Different rules apply to a successor beneficiary after the original beneficiary’s death. [3] If the original account owner was taking RMDs, then they had attained their Required Beginning Date. [4] IRS Notice 2024-35. https://www.irs.gov/pub/irs-drop/n-24-35.pdf [5] A Designated Beneficiary’s 10-year period begins on December 31st of the year following the year of the original account owner’s death. [6] Generally, the final distribution of the balance exceeds the Designated Beneficiary’s tenth year’s RMD.

National Life Group does not give legal or tax advice. The information is intended to be for educational purposes only. It must not be used as a basis for legal or tax advice and is not intended to be used and cannot be used to avoid tax penalties that may be imposed upon a taxpayer. Moreover, this presentation is not intended to be an all-inclusive review of estate planning concepts and strategies. Clients should consult with an appropriate legal or tax professional prior to acting upon any of the information contained herein.