July 24, 2024

Tax Benefits and Beyond: The Unique Appeal of 403(b)(9) Plans

Use these consumer marketing materials to help tell the story.

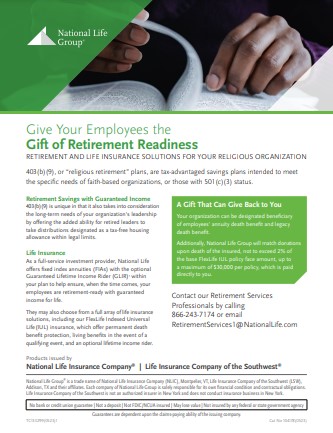

Are you actively engaged in the 403(b) or 457(b) market? Seeking to expand and diversify your client base? The 403(b)(9), also known as the “religious retirement plan,” offers distinct advantages over its 403(b) counterpart, making it an attractive option both for your prospects and employers.

Unlike 403(b) plans, life insurance is permitted within 403(b)(9) plans. Our Charitable Matching Gift (makes FlexLife IUL especially appealing in this market. Plus, 403(b)(9) payroll slots qualify for both the Slot Bonus Program and e$bee Awards.

Advantages of a 403(b)(9) payroll slot in alternative markets

→Tax Benefits: Contributions are made on a pre-tax basis, reducing taxable income.

→Employer Matching: Potential for employer contributions, boosting retirement savings.

→Flexibility: To whom they will offer the plan and make matching contributions, discretionary contributions, or none at all.

→Named as the beneficiary of participants’: Annuity death benefit & Legacy death benefit¹.

→Tax-Deferred Growth: Investments grow tax-deferred until withdrawal, enhancing growth.

→Flexible Contribution Limits: Higher contribution limits compared to other retirement plans.

→Considers the long-term needs of the organization’s leadership: Allows Ordained, licensed or commissioned minister employees to take non-taxable distributions for housing allowance in retirement.

Use these consumer marketing materials to help tell the story.

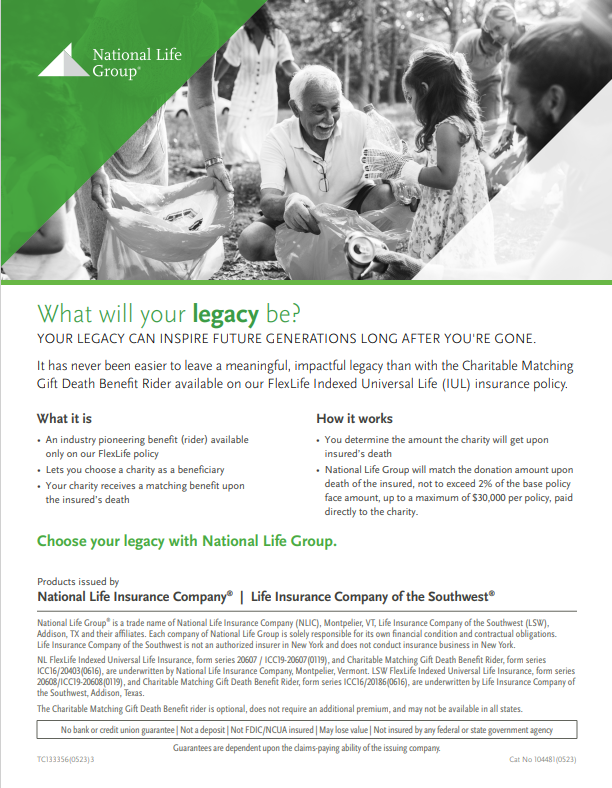

FlexLife Charitable Matching Gift Flyer (also available on CoBrand on Demand)

Slot Program Details:

To participate, the Slot Bonus Request Form must be completed and submitted prior to submitting the first application.

- Slot Bonus Program Rules

- Slot Bonus Request Form

- Employer Information Form

- Please consult the Employer Rules of Engagement for a framework of how you may engage with payroll slots.

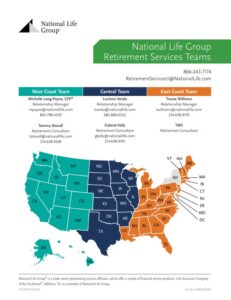

For more information contact your

Retirement Services Relationship Manager.

- Death benefit not to exceed 2% of the base FlexLife IUL policy face amount, up to a maximum of $30,000 per policy, which is paid directly to the charity.