June 8, 2023

State-Mandated Workplace Benefits Offer Unparalleled Opportunities to Grow Your Business!

Clients could potentially take advantage of up to $6,500 in tax credits for retirement planning.

Several states have mandated retirement plan access for employees of small businesses to address the retirement savings gap that many employees face, this has opened NEW markets for annuity sales!

Business owners impacted by these mandates can:

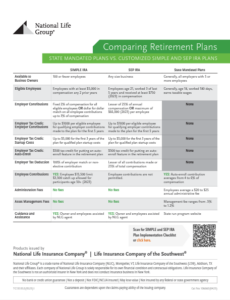

Make sure to register with the state, enroll all eligible employees in the state program, set up payroll deductions for each employee, or claim exemption by offering an alternative qualified plan, such as:

- SEP – (Simplified Employee Pension) IRA

- SIMPLE – (Savings Incentive Matching Plan for Small Employers) IRA

And potentially take advantage of up to $6,500 in tax credits for retirement planning!

Employers who have enrolled their employees in a state mandated retirement plan are not eligible for these tax credits.

Discover state mandates and start the SIMPLE or SEP IRA Simply Makes Sense conversation with these resources.

IRS Retirement Topics – Automatic Enrollment

Which states have mandatory retirement plans?

In an environment that is challenging to attract and retain high-quality talent, a SIMPLE IRA or SEP IRA may be just the alternative some employers/employees are looking for to provide a more employee-centric and customized retirement plan.