September 16, 2024

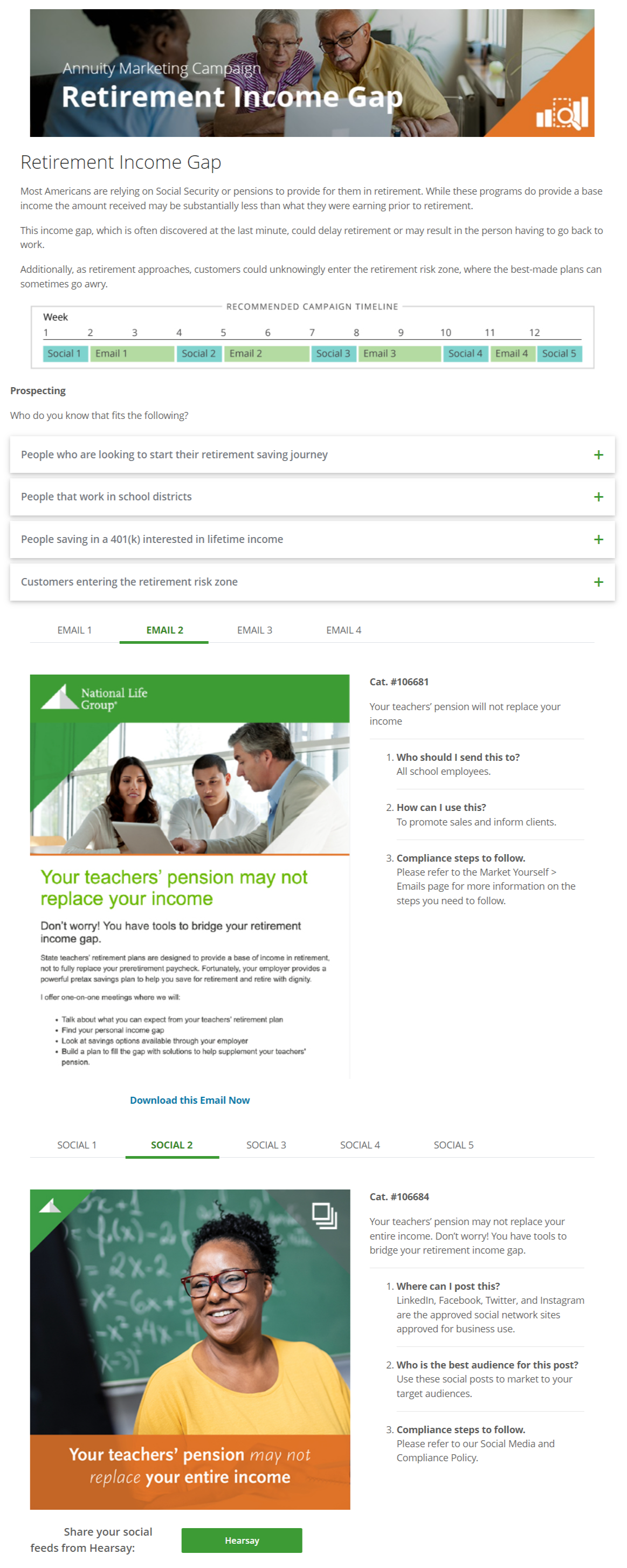

Retirement Reality Check: Pensions Alone are Not Enough

Help educators plan beyond their pension to secure retirement!

Many school district employees assume their state pension and Social Security – where applicable – will fully replace their income in retirement. However, neither are designed for complete income replacement which potentially leads to an income gap in retirement.

Consider this

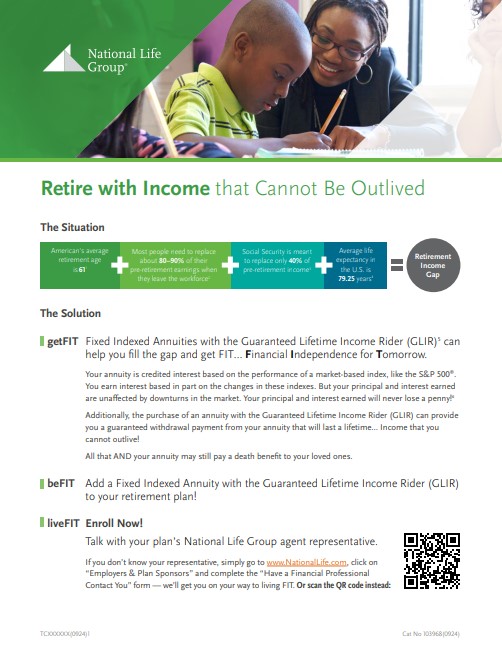

- Americans’ average retirement age is 61.1

- Most people need to replace about 80–90% of their pre-retirement earnings when they leave the workforce.2

- Social Security is meant to replace only 40% of pre-retirement income.3

- Average life expectancy in the U.S. is 79.25 years.4

Then, consider that teacher pension funding in the United States varies significantly by state. Collectively, there’s a substantial gap between what states have saved for teacher pensions and what they have promised to pay retirees.5

It’s critical for district employees to be educated on their benefits, how they work and what they can do now to improve their retirement income outlook!

Retire with Income that Cannot Be Outlived

Retire with Income that Cannot Be Outlived

You can help!

Click on the image below to start taking advantage of this turnkey marketing campaign designed to attract and convert leads into your customers for life.

(Agent Portal login required)

- https://www.fool.com/research/average-retirement-age/, March 2024

- https://www.aarp.org/retirement/social-security/questions-answers/income-replacement-rate.html, November 2023

- https://www.fool.com/retirement/2024/02/06/how-much-income-will-social-security-replace/, February 2024

- https://www.macrotrends.net/global-metrics/countries/USA/united-states/life-expectancy, U.S. Life Expectancy 1950-2024

- https://www.teacherpensions.org/topics/funding