March 25, 2025

Ready, Aim, Grow: New Performance Trigger Option

Launching April 7 for FPDAs and SPDAs.

Indexed annuities offer clients the potential to grow their savings based on the positive performance of a market index, while protecting their principal from market losses.

But what if clients could get credited interest even when the value of the market index didn’t increase?

That’s the promise of a new index crediting option that will become available for clients when they buy an indexed annuity from National Life.

S&P® 500 Performance Trigger Index Crediting Option

This new option will be added to:

- 3 new flexible premium indexed annuities (FPDAs) — Flex Secure Growth, Flex Secure Growth Bonus, and Flex Select Income.

- All of our Zenith and Driver single premium indexed annuities (SPDAs).

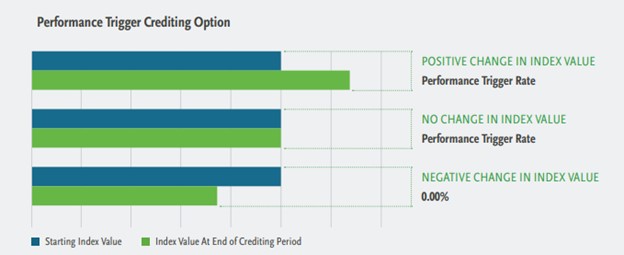

When the Market Index Gains Value — or Remains Unchanged

Clients will be credited a pre-set performance trigger interest rate:

- If the S&P 500® index value increases over the point-to-point period.

- If the market index value remains unchanged. So, even if growth is exactly 0%, your clients will get the performance trigger interest rate.

If the market index value is negative, clients are protected from market losses with the 0% floor. They won’t lose a penny of their principal, and interest is locked in.

When clients opt for the rate booster on the performance trigger crediting option, there will be a higher interest rate set than without the rate booster. There is a 1% charge for the rate booster options.

Performance Trigger is only available on SPDAs issued after April 7 and on the new Flex FPDAs.

Updated Product Highlights Flyers

Get our updated highlights flyers, reflecting this exciting addition to our index crediting options.

Complete the required annuity training today so you can sell these products!

“Standard & Poor’s®”, “S&P®”, “S&P 500®”, and “Standard & Poor’s 500™” are trademarks of Standard & Poor’s and have been licensed for use by National Life Insurance Company and Life Insurance Company of the Southwest. This Product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representations regarding the advisability of investing in the Product. The S&P Composite Index of 500 stocks (S&P 500®) is a group of unmanaged securities widely regarded by investors to be representative of large company stocks in general. An investment cannot be made directly into an index.