November 13, 2024

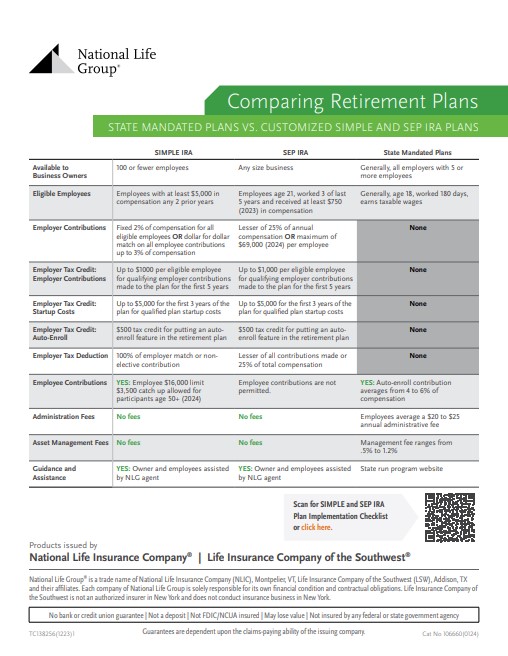

Q4 Drive: SEP Into the Future

The Q4 Drive is the time to talk to small businesses about the SEP IRA.

(SEP) IRA Highlights

- Up to 25% of compensation can be contributed – max contribution of $69,000

- Easy to set up with minimal tax reporting

- Business may deduct the contributions

- Portable when employees separate from service

- Ideal for smaller or sole proprietorship businesses

Help Them Seize the Opportunity

Check out our SEP resources and talk to business owners today.

Multicultural Checklists

SEP and SIMPLE IRA Checklist: Spanish

SEP and SIMPLE IRA Checklist: Chinese

SEP and SIMPLE IRA Checklist: Korean

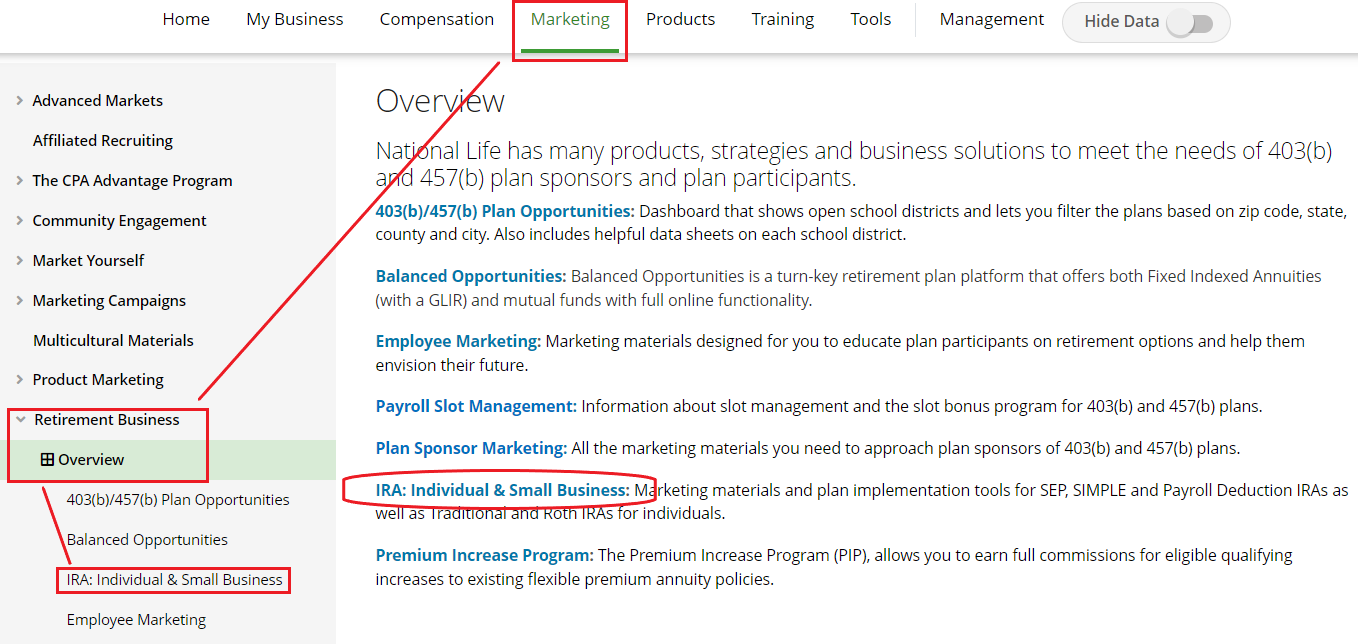

In an environment that is challenging to attract and retain high-quality talent, a SIMPLE IRA may be just the alternative some employers are looking for to provide a more employee-centric and customized retirement plan. To navigate from the Agent Portal homepage, go to Marketing > Retirement Business > IRA: Individual & Small Business

IRS Retirement Topics – Automatic Enrollment

Which states have mandatory retirement plans?

Questions? Contact the NLG Sales Desk at 800-906-3310.