May 23, 2024

Peace of Mind Comes From Annuity Awareness

Annuity Awareness Month is here, so take this opportunity to educate your clients on the benefits of these multipurpose products.

Three reasons why your clients’ retirement strategy should include a Fixed Indexed Annuity FIA:

Three reasons why your clients’ retirement strategy should include a Fixed Indexed Annuity FIA:

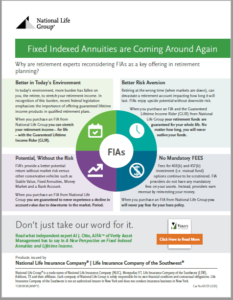

- There is more growth potential. With a FIA, clients are not directly participating in any stock or equity investments. Instead, interest is credited based in-part on the change of a market index, such as the S&P 500. This means your clients have greater interest crediting potential in an up market, but never lose value in a down market due to market declines.1

- It provides downside protection. With increased market volatility, it’s critical to ensure your client’s nest egg is protected when the market index is down. FIAs are structured so that if the index is down, they may not earn any interest, but the account value won’t decline due to market conditions. This means they will never earn less than 0%.

- A FIA with our Guaranteed Lifetime Income Rider (GLIR) can guarantee your clients with a stream of income during retirement, supplementing their pension and helping to close any retirement income gap.

Find consumer-facing emails and social media posts here: Annuity – Peace of Mind Campaign.

Upside Potential

One of the nicest features of a fixed indexed annuity is the ability for clients to earn interest based in part on changes in a market index. This means they have greater interest potential than a fixed annuity when the market performs well. They also have the protection of the floor, so when the index performs poorly, the client will never experience lower than 0% interest crediting. Use the following pieces to help your clients understand how this works:

Guaranteed Income Stream in Retirement

There are two parts to the retirement equation to solve for a potential gap between what a client earns now and what they’ll need in retirement: time x money. With more time, they can save less. With less time, they’ll need to save more. Using the Guaranteed Lifetime Income Rider will help clients be prepared to fill that void in the “Golden Years” as this piece can help you explain:

Why settle for the rest, when you can do business with the best?

Find consumer-facing emails and social media posts here:

As a result of National Life’s quarterly campaigns, you can better market yourself, your business, and the services you provide. Our step-by-step process and materials will guide you through the process.

Keep checking back as our campaign catalog continues to expand!

1Assuming no withdrawals during the withdrawal charge period. Rider charges continue to be deducted regardless of whether interest is credited.

Standard & Poor’s®”, “S&P®”, “S&P 500®”, and “Standard & Poor’s 500™” are trademarks of Standard & Poor’s and have been licensed for use by National Life Insurance Company and Life Insurance Company of the Southwest. The S&P Composite Index of 500 stocks (S&P 500®) is a group of unmanaged securities widely regarded by investors to be representative of large company stocks in general. An investment cannot be made directly into an index.