December 22, 2025

Help Clients Choose Interest Crediting Options in 2026

Starting January 24, Indexed Universal Life (IUL) insurance illustrations won’t have default allocations in the illustration system.

As an agent, you can help your clients understand how each interest crediting option works so that they can choose how to allocate money in their indexed universal life insurance policy to best align with their goals, risk tolerance, and long-term financial strategy.

Clients can choose to allocate all their money to one or more interest crediting options (or fixed-term strategy), including volatility-controlled indexes.

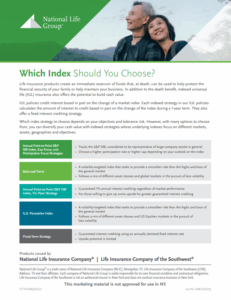

To help clients make this important decision, share the Which Index Should You Choose? flyer, which provides an overview of all IUL index crediting options and the fixed-term strategy.

Common Questions About Allocating Money in an IUL

Where can I find current rates for the different interest crediting options and the fixed-term strategy?

Log into the agent portal and go to https://www.nationallife.com/agent/products/interest-rates to see current illustrated rates, as well as rate histories. (You can also find annuity rates on this page.)

Do clients need to allocate the same percentage when choosing multiple index crediting options or the fixed-term strategy?

No, your client can allocate as little as 5% to an interest crediting option or fixed-term strategy. The total allocation must equal 100%.

Should clients check the Systematic Allocation Rider box?

The Systematic Allocation Rider (SAR) is designed for clients who make a single annual premium payment (or a 1035 exchange).

Instead of tying the entire premium to the index value on the day the payment is made, SAR divides the net premium into 12 equal portions. These portions are then allocated over a 12-month period.

Using the SAR does not guarantee improved performance or higher returns.

How can clients change allocations for existing policies?

Only the policyowner may change allocations. The easiest way to change allocations is in the customer portal or in the customer mobile app.

What happens to existing funds when allocations change?

Allocated money will remain in the selected index crediting options or fixed-term strategy until the segments reach their one-year maturity. Then, the money, along with interest earned, will automatically be allocated based on the new selections.

All new premiums are allocated based on the new selections.

TC8679312(1225)1