January 21, 2025

Now Is the Time to Make the Most of These IRA Sales Opportunities

Contributions to IRA and Roth IRAs for tax year 2024 can be made up to April 15, 2025.

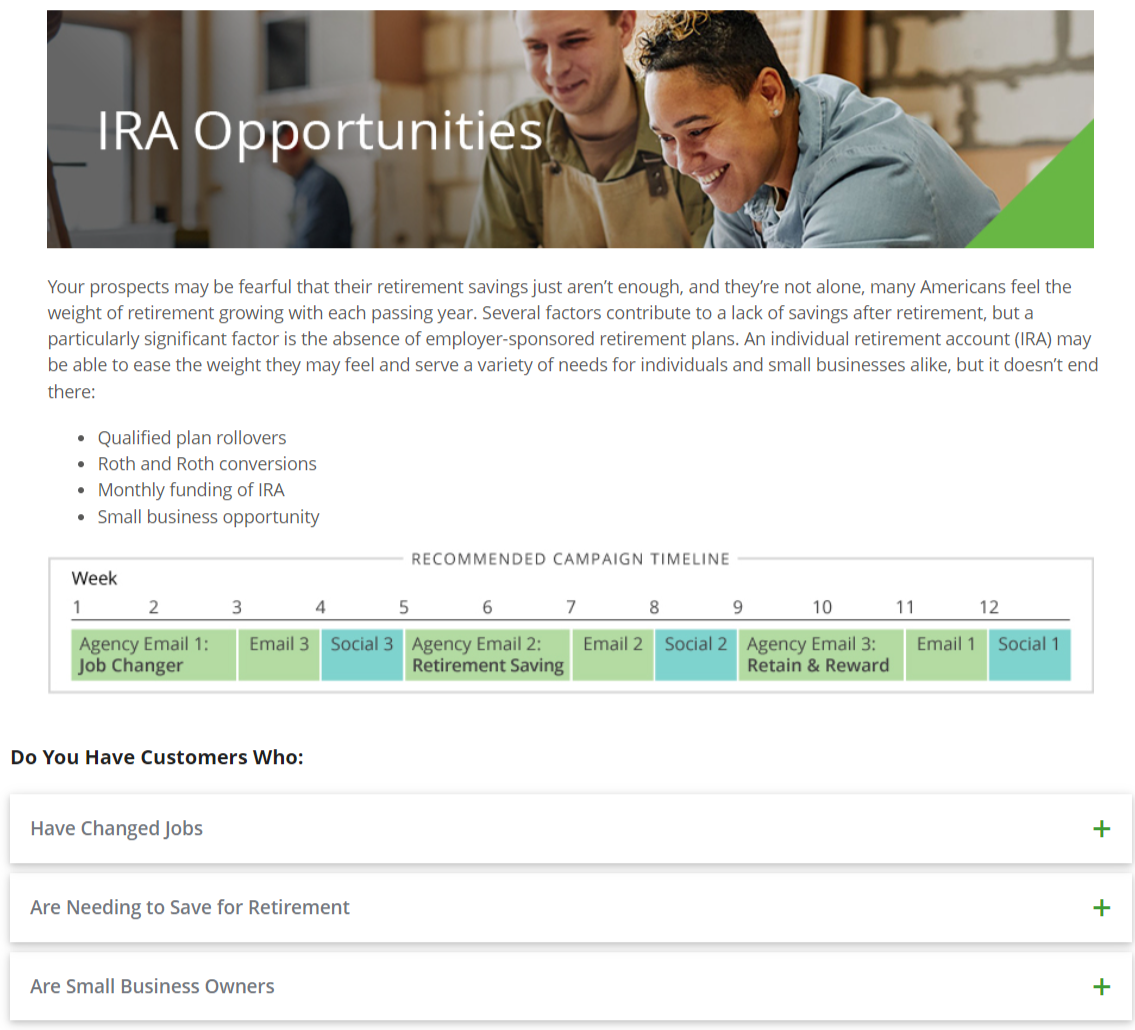

If your clients worry that their retirement savings are inadequate, they are not alone. In addition to the absence of employer-sponsored retirement plans, there are any number of factors contributing to a lack of savings after retirement.

The good news is individual retirement accounts (IRAs) may ease the weight of their concerns and can serve a variety of needs for individuals and small businesses. Some of the opportunities they provide are

IRAs

- Qualified plan rollovers into IRAs to continue tax deferral

- Tax deductibility of annual contributions

Roth IRAs

- Tax-free income at retirement for policies with the Guaranteed Lifetime Income Rider*

- No Required Minimum Distributions (RMDs)

- Tax-free death benefit for beneficiaries*

Additionally

- Low initial minimum of $100 a month to build savings

- Small business retirement plan options, SEP and SIMPLE IRA programs

*Assumes Roth Guidelines are met for tax-free distribution of interest earned

Contributions to traditional and Roth IRAs for tax year 2024 can be made up to April 15, 2025.

Get started

Click the buttons below for campaign strategies and tools to attract and convert more leads into customers.