April 3, 2023

Inforce Policy Contract Changes are Simpler With e-App!

No second guessing! e-App prompts all necessary questions and forms.

Introducing a simpler way to complete an Inforce Policy Contract Change request – directly through e-App.

Taking advantage of our e-App platform, these requests can be initiated with full confidence that the right questions are being answered and the right forms are being completed. Benefits that you’ll experience:

- Easy to navigate electronic application through our e-App platform.

- No second guessing! Policy changes can be complex. The policy change e-application will guide you through this process and prompt all the necessary questions and forms.

- Contract Change applications will be electronically submitted to NLG – no more scanning and emailing!

- Expedite overall change process by submitting all of the right documents in the first time. *

- *Important: Reach out NLG home office to get quoted requirements before submitting a change request, because the underwriting guidelines are based on when the policy was issued and not current underwriting guidelines.

- e-App now allows agents to complete all application types – new apps, term conversions and policy changes!

- When do I use the Policy Change Application?

- The Policy Change Application is used to for the following changes to a Life insurance policy:

- Face Changes

- Death Benefit Option Change

- Class Change (smoker/tobacco status change)

- Remove/Reduce a rating

- Reinstatement

- Add/Cancel Riders

- The Policy Change Application is used to for the following changes to a Life insurance policy:

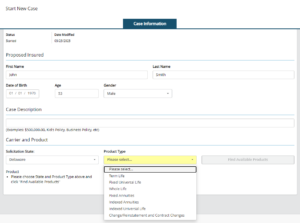

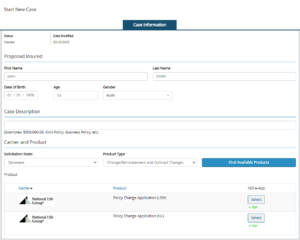

- Where do I access the Inforce Contract Change application?

- The Policy Change Application is located in e-app. Choose Change/Reinstatement and Contract Changes from the Product Type picklist.

- Is there anything required prior to completing a Policy Change Application?

- Yes, it is very important to get quoted requirements from the Contract Change team before submitting the application when adding a Rider, Increasing a Face Amount, Reinstatements, Class Changes, Rate removal/reductions. Email ContractChange@NationalLife.com for the necessary underwriting requirements. Please include: the insured’s name, policy number, and the type of change you are requesting to be quoted. Requirement quotes are completed within 5 business days.

- Is underwriting required for a Contract Change?

- Depending on the type of change being requested, underwriting may be required. Your Contract Change Requirements quote will let you know what underwriting requirements will be needed. Additional requirements may be needed at the underwriter’s discretion.

- Can I still submit a paper application for a Contract Change?

- Yes, paper applications can be submitted to ContractChange@NationalLife.com. Please note: paper applications require a wet signature on all forms.

- Are there any limits to Contract Changes?

- The face amount cannot be decreased in the first year IUL and UL

- UL, IUL, and VUL has a maximum decrease of 25% of face for policies less than 8 years old

- Contracts cannot be reduced to a face amount less than the minimum for the product type

- Death Benefit Option changes are not available until after the first policy anniversary

- For policies issued before January 2021, the only riders that can be added to the policy are ABRs, LIBR and APB. WP and BSB riders are not available after issue on any products. If you are unsure of what options are available, reach out to ContractChange@NationalLife.com.

- Each product has different eligibility requirements. Requesting a quote from Contract Change will ensure your change request is available and what requirements are needed.

- Best Practices:

- For Term and Whole Life policies please list policy number with two leading 00s and two 00s at the end of the policy number. NL/LS prefix is not needed. Ex: 00124532100

- For IUL, UL and VUL policies, please list policy number with two leading 00s and the LS/NL prefix. Ex: 00LS1234567