January 6, 2025

How SEP and SIMPLE IRAs Can Strengthen Your Small Business Network

Marketing now updated with IRS 2025 guidance.

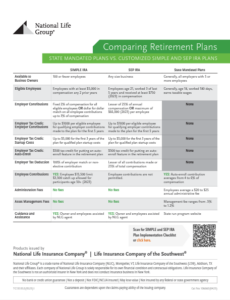

It’s well-known that the U.S. is grappling with a retirement savings crisis. One key factor exacerbating this problem is the insufficient number of retirement plans offered by businesses nationwide. In response, states have begun taking legislative action to tackle this issue. In several states, small business owners who do not have an employer-sponsored retirement plan must provide one. Many states are expected to follow.

However, default programs aren’t the only way for business owners to meet their state requirements. Solutions exist in the form of SIMPLE and SEP IRA plans which can be customized to align more closely with the goals and objectives of the business owner and their employees. You can leverage this opportunity to prospect and set appointments with small business owners across the country, regardless of state mandates.

SEP vs SIMPLE IRA

- SEP IRA (Simplified Employee Pension IRA):

- Designed for small businesses and self-employed individuals.

- In 2025, employers contribute to employees’ SEP IRAs, limited to 25% of each employee’s salary or $70,000 (whichever is lower).

- SIMPLE IRA (Savings Incentive Match Plan for Employees):

- Designed for small businesses with fewer than 100 employees.

- Employers can match employee contributions or make non-elective contributions of up to 3% of eligible employees’ compensation.

- In 2025, employees can defer 100% of pay up to $16,500.

Ref:

SEP & SIMPLE IRA vs. State Mandate Generic

Cat No. 106660

Getting the Conversation Started

See also, SEP & SIMPLE IRA vs.

CalSavers Cat No. 106294

Illinois Secure Choice Cat No. 106477

Colorado SecureSavings Cat No. 106502

Agent Portal login required

IRS Retirement Topics – Automatic Enrollment

Which states have mandatory retirement plans?