June 16, 2022

How Can You Promote Annuity Awareness?

Think about what your clients are looking for when planning for retirement...

Is it safe to say that most of them desire at least one of the following: protection of premium, deferring taxes, upside interest crediting potential or a GUARANTEED income stream?

A fixed indexed annuity with National Life Group can solve ALL of these desires, if used properly.

June is Annuity Awareness Month, so take this opportunity to educate your clients on the benefits of these multipurpose products. We have just the tool to address some initial concerns they may have about using annuities.

Protection of Premium

All of our fixed and fixed indexed annuity products offer protection of premium from market volatility as long as the client doesn’t cancel their policy prior to the end of the surrender period. Take a look at this marketing piece to help drive home that important fact:

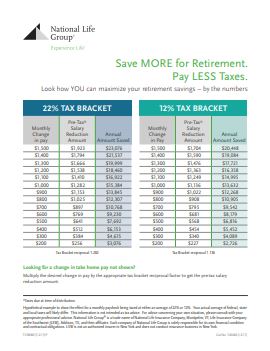

Deferring Taxes

When a client puts money into an annuity, they get to defer the taxes on the interest earned, until they withdraw the funds from the policy. For a qualified annuity, they also get to defer income taxes on the principal. For the same interest rate, a tax-deferred account will grow faster than one that is taxed on the interest earned every year. This also gives the client the opportunity to spread out the tax bill in retirement through the use of the income rider or systematic withdrawals. For plans using pretax dollars to contribute, such as a 403(b), it also allows the client to save more while minimally reducing the change in their take-home pay. You can use this marketing piece to relay that information:

Upside Potential

One of the nicest features of an indexed annuity is the ability for clients to earn interest based in part on changes in a market index. This means they have greater interest potential than a standard fixed annuity when the market performs well. They also have the protection of the floor, so when the index performs poorly, the client will never experience lower than 0% interest crediting. Use the following pieces to help your clients understand how this works:

How Fixed & Indexed Annuities Work

Guaranteed Income Stream in Retirement

There are two parts to the retirement equation to solve the gap between what a client earns now and what they’ll earn in retirement: time x money. With more time, they can save less per contribution. With less time, they’ll need to save more per contribution. Using the Guaranteed Lifetime Income Rider will help clients be prepared to fill that void in the “Golden Years” as this piece can help you explain: