June 26, 2023

Exploring Alternative Markets: The Perks of a 403(b)(9) Payroll Slot

The distinguishing features that make it especially attractive for you to sell, and for employers to implement.

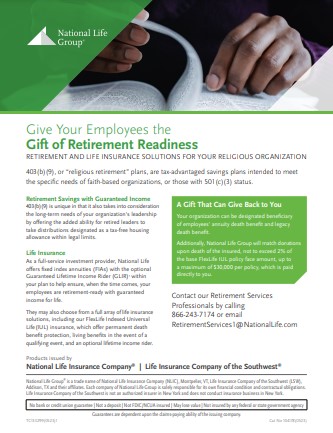

If you are currently active in the 403(b) or 457(b) markets and are interested in growing and diversifying your customer base, consider another kind of payroll slot. The 403(b)(9), or “religious retirement,” plan has some key distinguishing features from its 403(b) “parent” that make it especially attractive to sell, and for employers to implement.

Unlike 403(b) plans, life insurance is permitted within 403(b)(9) plans. And National Life’s Charitable Matching Gift makes FlexLife IUL especially appealing in this market. Plus, 403(b)(9) payroll slots qualify for both the Slot Bonus Program and e$bee Awards.

There are plenty of perks for the employer too! The employer…

Maintains flexibility in deciding

• To whom they will offer the plan

• To make matching contributions, discretionary contributions, or none at all

Can be named as the beneficiary of participants’

• Annuity death benefit

• Legacy death benefit

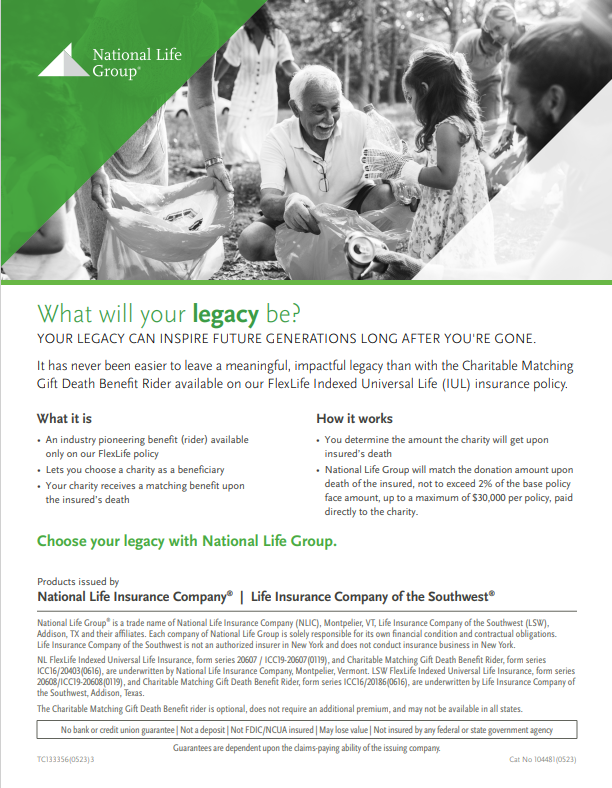

Additionally, National Life Group will match donations upon death of the insured, not to exceed 2% of the base FlexLife IUL policy face amount, up to a maximum of $30,000 per policy, which is paid directly to the charity.

Considers the long-term needs of the organization’s leadership

• Ordained, licensed or commissioned minister employees to take non-taxable distributions for housing allowance in retirement.

How the Housing Allowance Works

Employees can take non-taxable distributions for housing allowance in retirement. Starting at age 59½, funds withdrawn and used for allowable housing related expenses are excluded from income in that year and therefore not subject to federal income tax. (This assumes the ordained, licensed or commissioned minister-employee is not still living in church-provided housing and/or being reimbursed for housing expenses.)

Examples of tax-free housing allowance expenses are

- Mortgage payments (principal and interest)

- Rent payments (if you rent instead of own)

- Real estate taxes

- Property insurance

- Utilities (gas, electric, water, sewer, trash pick-up, local phone service)

- Appliances and furniture (purchases/rental costs and repair)

- Remodeling expenses

- Homeowners Association dues

- Pest control

Note: The IRS does impose limitations on the total dollar amount of expenses excluded from tax obligation.

Use this consumer marketing material to help tell the story.

FlexLife Charitable Matching Gift Flyer (also available on CoBrand on Demand)