September 23, 2024

Clients with No Employer Retirement Plan?

No problem! Explore Traditional and Roth IRAs for tax-advantaged retirement savings.

Many individuals mistakenly believe that without an employer-sponsored 401(k), their only retirement savings option is a traditional bank savings account. However, there are more advantageous alternatives available, such as Individual Retirement Accounts (IRAs) and Roth IRAs, which provide significant tax benefits and other advantages. It is crucial to present all available options to your clients, enabling them to make well-informed decisions about their retirement savings plans.

As of 2024, approximately 57 million Americans do not have access to an employer-sponsored retirement plan.* This represents a significant portion of the workforce, highlighting the importance of exploring alternative retirement savings options such as IRAs and Roth IRAs.

Traditional and Roth IRAs represent a straightforward and cost-effective solution for the middle market, offering a compelling sales opportunity to expand your client base and enhance their financial security.

You can help!

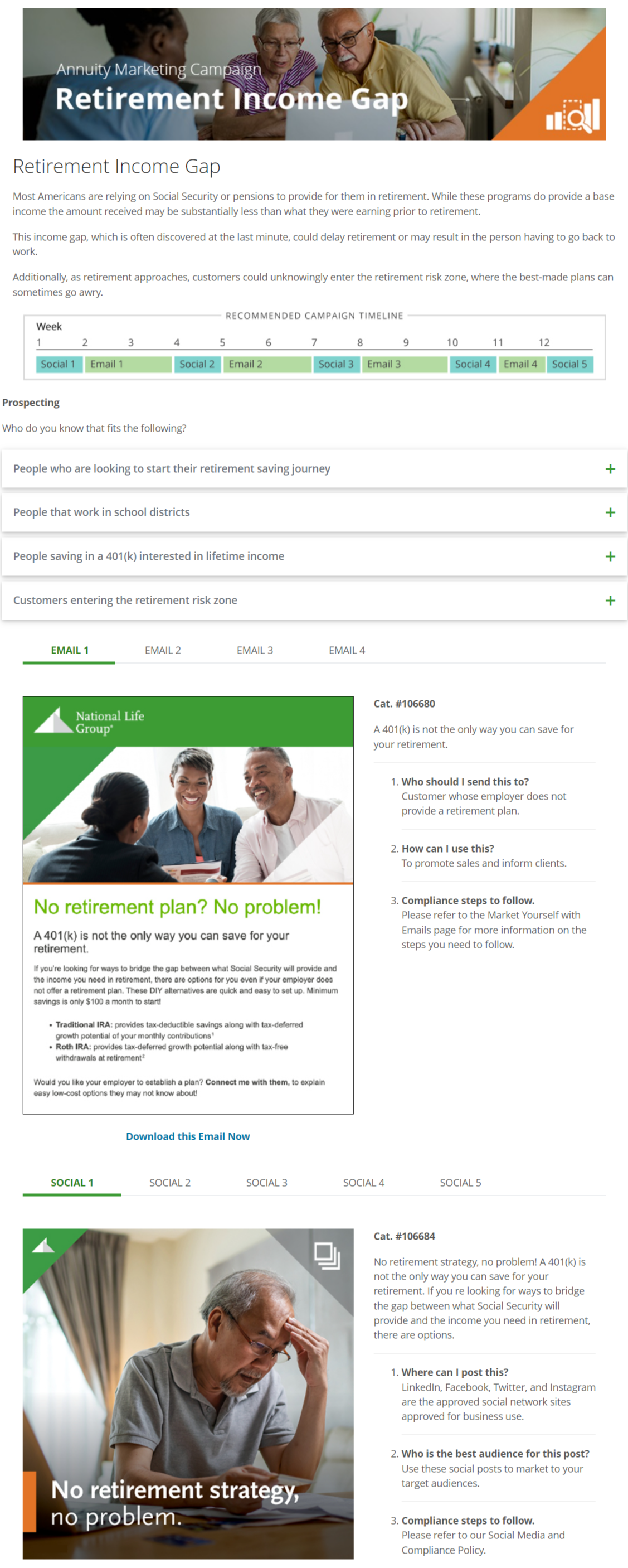

Click on the image below to start taking advantage of this turnkey marketing campaign designed to attract and convert leads into your customers for life.

(Agent Portal login required)

* 50+ Essential Retirement Statistics for 2024: Demographics (annuity.org)