July 18, 2024

An Unprecedented Opportunity to Grow Your Business

Start the SIMPLE & SEP IRA conversation with these resources!

With the SECURE Act, small businesses could be eligible for tax credits, and employer contributions to SIMPLE IRAs and SEP IRA plans are tax deductible!

A Simple IRA plan or SEP IRA plan can provide a simplified way to contribute toward retirement. This retirement plan option is designed to be straightforward and cost-effective, making it particularly appealing to employers looking for a manageable yet impactful way to support their employees’ long-term financial security. In several states, small business owners who do not have an employer-sponsored retirement plan must provide one. Many states are expected to follow.

Most small business owners think the only option is a 401(k), which can be expensive and complicated to set up. Talk with them about the Simple IRA and SEP IRA options provided by the IRS specifically for small businesses seeking a low-cost plan that’s easy to administer and maintain.

Spot the Opportunity

Business owners willing to contribute to employee savings with less than 100 employees– The Simple IRA

Sole proprietorships and small businesses where the business owner is willing to be the sole funding source – The SEP IRA

Plus, in states that require businesses to have a retirement savings plan, these are very cost-effective options!

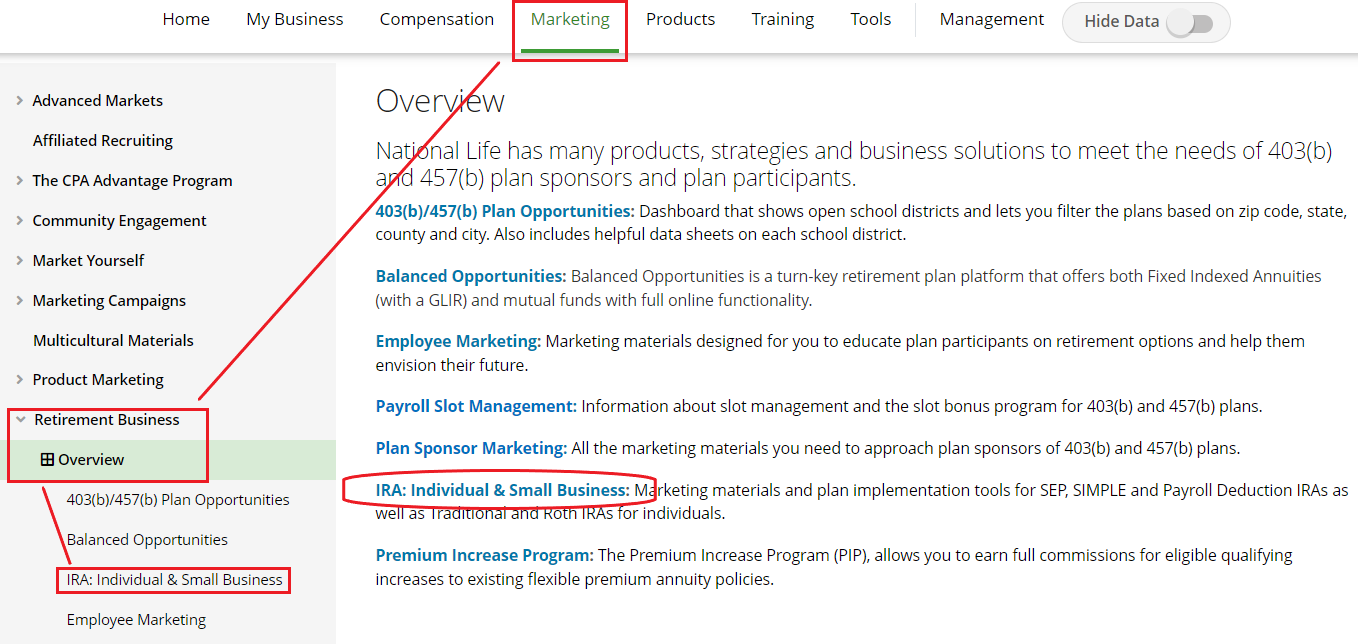

In an environment that is challenging to attract and retain high-quality talent, a SIMPLE IRA may be just the alternative some employers are looking for to provide a more employee-centric and customized retirement plan. To navigate from the Agent Portal homepage, go to Marketing > Retirement Business > IRA: Individual & Small Business

IRS Retirement Topics – Automatic Enrollment

Which states have mandatory retirement plans?