May 8, 2024

IRAs: Individual & Small Business

IRAs can be a powerful tool for small business owners and individuals to meet long-term financial goals.

Why IRAS? Why now?

- They provide a powerful tool for retirement savings.

- Interest compounds year-over-year, making a significant difference in overall retirement savings.

- Depending on the IRA, clients can defer taxes on the money going in now or have tax-free withdrawal of the money coming out later if Roth rules are met.

- A tax-deductible IRA contribution lowers adjusted gross income (AGI), which is used to calculate certain itemized tax deductions and your client’s tax rate.

- Individuals can consolidate their qualified accounts into an IRA to protect their retirement with the option to continue contributing to their retirement.

Click below to view prospect profiles.

For clients seeking tax deferral on contributions and a tax deduction.

Roth IRA

For clients seeking tax-free withdrawals in retirement.

Sales Strategy

Legacy IRA Using Life Insurance

For clients who want to optimize IRA assets beyond their own retirement to leave a lasting legacy.

For small business owners seeking retirement benefits, tax credits/deductions and to meet State Mandates’ requirements.

SIMPLE IRA

For employers with less than 100 employees, seeking retirement benefits, tax credits/deductions, and to meet State Mandate requirements.

Payroll Deduction IRA

The Payroll Deduction IRA is probably the simplest retirement arrangement that a business can have. No plan document is needed under this arrangement.

Sales Opportunity

State-mandated Workplace Retirement Plans

Several states already mandate small business owners to provide retirement plans to their employees; other states will follow.

To go directly to marketing materials and plan implementation tools supporting your IRA business, click here.

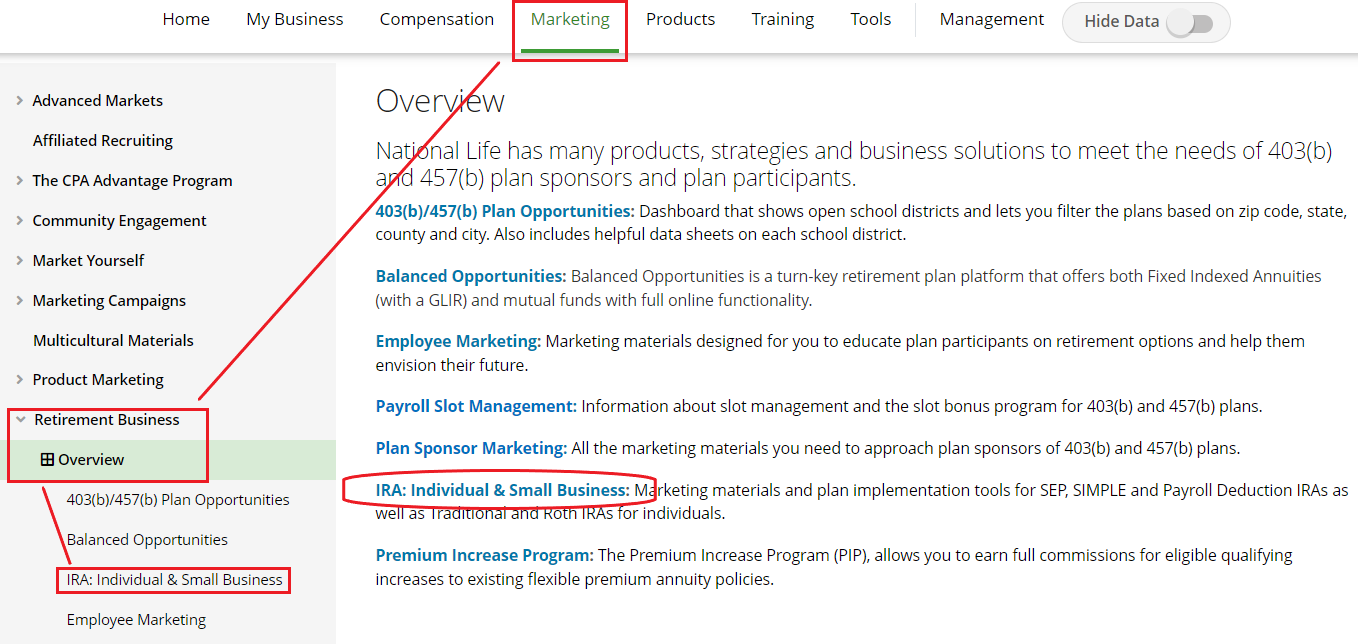

To navigate from the Agent Portal homepage, go to Marketing > Retirement Business > IRA: Individual & Small Business