August 1, 2018

Wait…Cash Isn’t King?

A reminder on National Life Group policy payment guidelines…

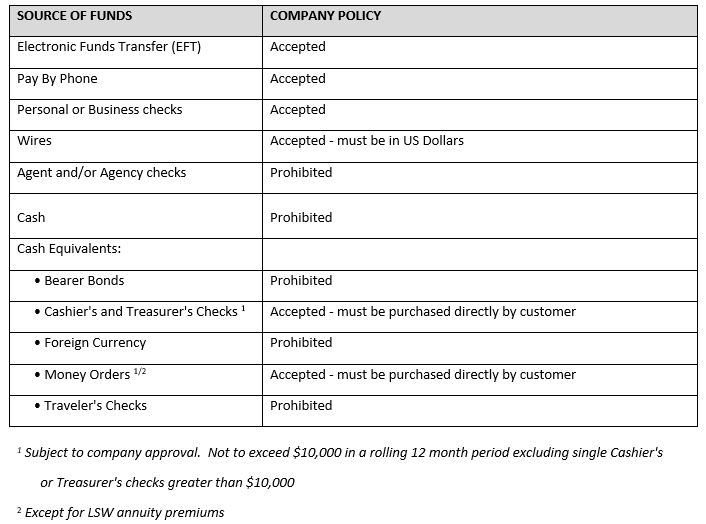

As part of the National Life Group Anti-Money Laundering (AML) compliance program, we define the types of funds that can be used for policy payments. The chart below details acceptable sources of funds for policy payments. Please note that whenever Cash Equivalents are given directly to the agent to submit to National Life Group (NLG), a Cash Equivalent Payment Receipt must be completed with a copy going to the client and a copy submitted to NLG with the funds. Cash should never be taken by the agent from a client for a policy payment. Please remind your clients when submitting policy payments directly to NLG to clearly indicate their policy number, name, and address, on or with the payment.

Q&A

What happens if a client submits funds that are prohibited – like cash or a traveler’s check?

While we hope that communication of this policy will prevent this from happening, if we receive cash in the mail, we will deposit it according to our procedures, but will send a letter to the client letting them know that we do not accept cash. We will provide them with alternate forms of payment (see above chart for acceptable payments). Should this happen again from the same client, we will return the funds. If we receive a non-cash prohibited form of payment, like a Traveler’s check, we will return it to the client requesting an alternate form of payment.

What should I do if my client tries to give me cash to pay for their premium payment?

If your clients tries to give you cash, please let them know that cash is not an acceptable form of payment and let them know that we accept personal checks, Electronic Funds Transfer, money orders or bank checks (subject to the rules outlined above).

What happens if a client submits more than $10,000 in money orders in a 12 month period?

If a client submits more than $10,000 in money orders in a 12 month period, all money orders received on a given day that meet or exceed the $10,000 threshold will be returned and we will request an alternate form of payment (see chart above for acceptable forms of payments)

When is the Cash Equivalent (CE) Payment Receipt (Form 7953) needed?

The CE Payment Receipt is needed whenever cash equivalents are submitted through the agent or agency. Cash equivalents include money orders and bank checks (Cashier’s Check, Treasurer’s Check or Official Bank Checks). The CE Payment Receipt is for the protection of the:

Client – proof that the cash equivalent payment was given to the agent or agency – documents date and amount received.

Agent and agency – documents the origins of the funds to comply with Anti-Money Laundering guidelines.

If you have any questions regarding this, please contact Kathy Drury (kdrury@nationallife.com) in Treasury Operations or Christie Keene (ckeene@nationallife.com) in Market Conduct & Compliance.

| TC102212(0718)1 |