February 2, 2023

There’s Still Time to Save on 2022 Tax Liability!

The window of opportunity is still open for business owners to establish and fund a qualified plan for their 2022 Tax Filing.

Sponsoring a qualified plan provides a great deal of benefits to businesses including tax deductions, retirement savings and an increase in employee morale. While the 2022 year has come to an end, the window of opportunity is still open for business owners to establish and fund a qualified plan.

Following passage of the Secure Act in 2020, businesses have until their tax filing deadline (plus extensions) to establish and fund a qualified plan where the contribution is 100% employer funded such as SEP IRAs, Profit Sharing plans, 412e3 plans and more.

Many business owners are not aware these plans can still be established. Furthermore, many CPAs are also unaware of this extension and the benefits it can provide to their clients. Educating both business owner clients and the CPAs that support them about qualified plans, and the advantages that they can still offer, provides a valuable opportunity to further expand your business.

Get started!

National Life is here to assist in helping your client establish a qualified retirement plan.

Our Advanced Markets Team can discuss the various options that exist in this space and design a proposal for a plan that aligns with the goals and objectives of your business owner client.

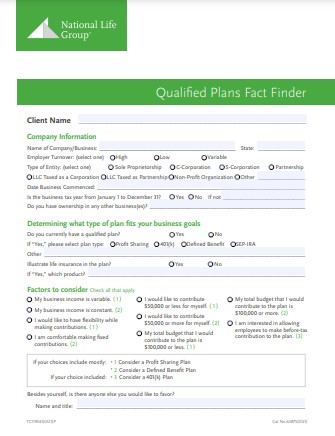

To get started, download and complete this Qualified Plan Fact Finder; email the completed form to QPM@nationallife.com.

From One Agent to Another

Take a moment to watch this video interview with

Scott Levin, CFP, AIF

Worthington Financial Partners

Browse these resources for additional information, marketing and sales tools on these topics.

You have direct access to the Advanced Markets Team for case consultation and point-of-sale support.

Learn more about the team on NationalLife.com

Need Help? Contact us at 1-800-906-3310, Option 1

or learn more on the Agent Portal,

look for this icon under Guides on the right side bar: