February 23, 2023

Life Insurance: For Anyone who Loves

February—the month of love—is the perfect time to reach out to clients and prospects about their life insurance needs

Valentines Day may have been last week, but protecting and loving family matters every day. There’s no better time to show your devotion to clients by educating them on the benefits of life insurance. Be prepared with the right materials to educate and inspire them about the importance of life insurance at any stage of life. New Baby? Growing Family? Single Parent Warrior? Empty Nester? No matter where they’re at, they need Life Insurance for those they love.

A single parent – Your client is the epitome of resilient, they juggle being a chauffeur, short-order cook, homework maven, dryer of tears…also known as a single Mom or Dad. It is rewarding and touching, especially if they are their children’s one and only provider. But, have they considered what would happen if they were no longer there to take care of them? (lifehappens.org) Or, what if they became terminally or chronically ill and were unable to care for their children fully?

See below our flyer on Life Insurance with Living Benefits that briefly describes how life insurance can help your clients’ children if they were to pass away or become ill.

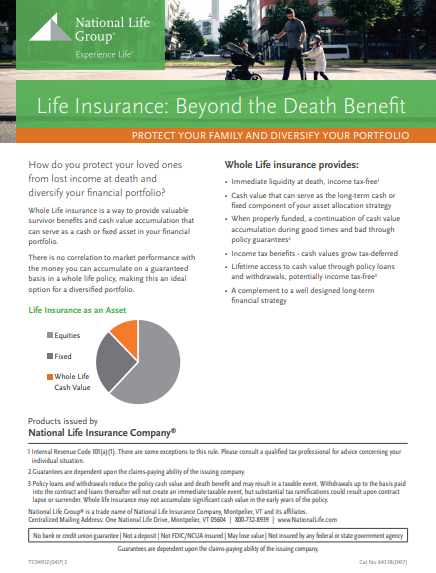

A growing a family – Your clients start a family and learn what it really means to love. But, have they considered what would happen if they were no longer there to take care of their loved ones? (lifehappens.org) What if you were able to offer your clients an income tax-free death benefits and cash value, GUARANTEED? See below for our marketing resources on diversifying your portfolio through our Whole Life insurance products, as well as our Protecting the Ones Who Depend on You flyer to help clients determine how much insurance protection they really need.

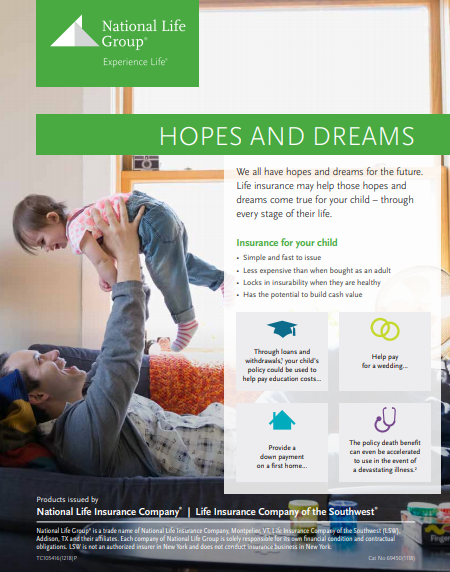

A first child – They welcome a baby, and suddenly their world shrinks to the new life they can hold in their arms. But, have they considered what would happen if they were no longer there to take care of their newborn? (lifehappens.org) Or, what about life insurance that they do not have to die to use, such as to help their children with college expenses, a wedding, down payment on a first home, etc.?

CLICK HERE to view our Hopes and Dreams Flyer, and show your clients the benefits of purchasing life insurance to protect themselves and their children.

Additional resources available on your agent portal under the Marketing tab

Questions? Contact our Sales Desk at 1-800-906-3310, option 1.

Consumer materials linked to in this communication are approved for print use only. Please note that email marketing is subject to additional anti-spam requirements, and should be submitted for advertising compliance approval prior to use.