June 15, 2023

Leverage SECURE 2.0 Act to Grow Your Business

New mandates require states to offer retirement plan access to employees - resulting in new markets for annuities.

Congress passed new rules in the SECURE Act that offer tax credits for small business owners! They could take advantage of up to $5,500 in startup credits and up to $1,000 in credits per employee by establishing a retirement plan! Several states have mandated retirement plan access for employees of small businesses to address the retirement savings gap that many employees face, this has opened NEW markets for annuity!

What they need to do is:

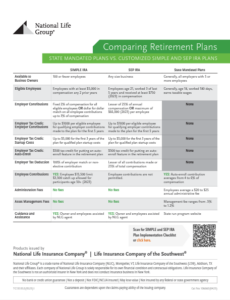

The employer must register with the state, enroll all eligible employees in the state plan, set up payroll deductions for each employee, or offer an alternative qualified plan that meets the following criteria:

- SEP – (Simplified Employee Pension) IRA

- SIMPLE – (Savings Incentive Matching Plan for Small Employers) IRA

Employers who have enrolled their employees in a state mandated retirement plan are not eligible for these tax credits.

Equip yourself with the knowledge to start leveraging the SECURE 2.0 Act

and take advantage of these excellent resources to start the SIMPLE or SEP IRA Simply Makes Sense conversation today!

IRS Retirement Topics – Automatic Enrollment

Which states have mandatory retirement plans?

In an environment that is challenging to attract and retain high-quality talent, a SIMPLE IRA or SEP IRA may be just the alternative some employers/employees are looking for to provide a more employee-centric and customized retirement plan.