June 22, 2023

Don’t Miss Out: Annuity Awareness Month “Must-Have’s”

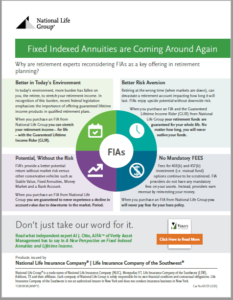

Use our marketing flier and Verity Asset Management White Paper to educate your clients on the importance of a diversified retirement plan.

This Annuity Awareness Month and beyond, use our marketing flier and Verity Asset Management White Paper to share with your clients the importance of having a diversified retirement plan by adding a FIA to their 403(b) or 457(b).

Check out these three reasons why your clients’ retirement plan should include an FIA.

- There is more growth potential. With an FIA, clients are not directly participating in any stock or equity investments. Instead, interest is credited based in-part on the change of a market index, such as the S&P 500. This means your clients have greater interest crediting potential in an up market, but never lose value in a down market due to market declines.1

- It provides downside protection. With increased market volatility, it’s critical to ensure your client’s nest egg is protected when the market index is down. FIAs are structured so that if the index is down, they may not earn any interest, but your cash value won’t decline due to market conditions. This means they will never earn less than 0%.

- An FIA can guarantee your clients with a stream of income during retirement. With supplementing their pension and helping to close their retirement income gap. According to the Insured Retirement Institute, 95% of consumers are very or somewhat interested in owning an annuity that

provides a guaranteed income each month.2

Then, find consumer-facing emails and social media posts here

Annuity Awareness Month is almost over!

Take this opportunity to educate your clients on the benefits of these multipurpose products.

Upside Potential

One of the nicest features of an indexed annuity is the ability for clients to earn interest based in part on changes in a market index. This means they have greater interest potential than a standard fixed annuity when the market performs well. They also have the protection of the floor, so when the index performs poorly, the client will never experience lower than 0% interest crediting. Use the following pieces to help your clients understand how this works:

Guaranteed Income Stream in Retirement

There are two parts to the retirement equation to solve the gap between what a client earns now and what they’ll earn in retirement: time x money. With more time, they can save less per contribution. With less time, they’ll need to save more per contribution. Using the Guaranteed Lifetime Income Rider will help clients be prepared to fill that void in the “Golden Years” as this piece can help you explain:

Why settle for the rest, when you can do business with the best?

Find consumer-facing emails and social media posts here:

As a result of National Life’s quarterly campaigns, you can better market yourself, your business, and the services you provide. Our step-by-step process and materials will guide you through the process.

Keep checking back as our campaign catalog continues to expand!

1Assuming no withdrawals during the withdrawal charge period. Rider charges continue to be deducted regardless of whether interest is credited.

2Why Most Consumers Want Guaranteed Lifetime Income, Financial Advisor, Feb. 25, 2020