March 12, 2024

A Practical Solution Using Modern Life Insurance

Get everything you need to launch the Indexed Universal Life and the Lifetime Income Benefit Rider (LIBR) campaign in your local market.

Do your clients know how much money it takes to give themselves an income of $100,000 per year in retirement?

1 Million? 1.5 Million? 2 Million? More?

Do they know how many years they will live in retirement?

- Start by understanding the longevity risk, an estimate of their life expectancy. Doing so will better prepare them for important decisions they’ll face as they near retirement. The Social Security Administration offers this calculator.

- Add guarantees in an unexpected way. Though the primary purpose of life insurance is to provide a benefit at death, some policies can do so much more. An Indexed Universal Life insurance policy with the Lifetime Income Benefit Rider from National Life could be their solution.

Help your clients retire with peace of mind knowing the number one risk Americans face in retirement

– outliving savings –

is one concern they don’t have to worry about.

Indexed Universal Life and the Lifetime Income Benefit Rider (LIBR) Campaign

Indexed Universal Life and the Lifetime Income Benefit Rider (LIBR) Campaign helps you identify sales opportunities, engage and activate prospects, and enable sales growth with easy-to-use marketing tools and resources. Get everything you need launch the Indexed Universal Life and the Lifetime Income Benefit Rider (LIBR) campaign in your local market below.

- American Institute of CPA’s, Oct 7, 2023

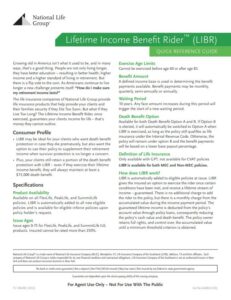

The Lifetime Income Benefit Rider provides a benefit for the life of the insured if certain conditions are met, including but not limited to the insured’s attained age being between age 60 and 85, and that the policy has been inforce at least 10 years. Insufficient policy values or outstanding loans may also restrict exercising the rider.

Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless the client has a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products.